If you’re a freelancer, self-employed, or a professional in the Philippines, one of the first big questions you’ll face during registration (and every new year after that) is:

Should I choose the graduated income tax or the 8% income tax option?

Both options are legal under the TRAIN Law, and both are fully recognized in Revenue Regulations 8-2018 and Revenue Memorandum Order 23-2018. But they affect your taxes very differently, so choosing wisely can save you a lot of money and headaches.

In this article, we’ll break them down in a friendly, practical way, complete with examples, tips, and insights from actual BIR rules.

Tax Calculator

Manually computing your tax due can be daunting. And even though you will encounter sample tax computations throughout this article, you don’t actually have to do your calculations manually.

Use the tax calculator below by simply inputting your gross sales and business expenses (if applicable), and you will know your tax due right away. This is a useful tool for new taxpayers trying to decide which tax option to pick or already registered taxpayers who want to estimate their upcoming tax due.

Income Tax Calculator

What Are Your Two Main Options?

When you’re registered as self-employed (individual), you may choose between two broad income tax systems: the graduated income tax and the 8% flat income tax.

Here’s an overview of the key differences.

| Feature | Graduated Tax | 8% Flat Rate |

|---|---|---|

| Based On | Net Income | Gross Receipts (less ₱250k) |

| Deductions Allowed? | Yes (Itemized/OSD) | No |

| Percentage Tax? | Yes (3%) | No |

| Best For | High-expense businesses | Low-expense businesses |

| Threshold Limit | None | Must be < ₱3M |

| Annual Re-election? | No | Yes |

Let’s go deeper.

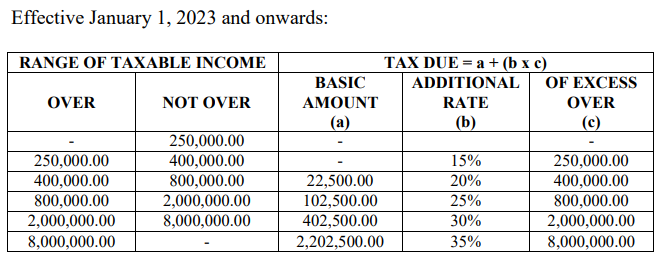

Option 1: Graduated Income Tax

This is the default system. It uses the TRAIN Law tax bracket, starting at 0% for the first ₱250,000 of taxable income, up to 35% for income greater than ₱8 million. Under this option, your tax is based on:

Gross Income – Allowed Deductions = Taxable Income

Allowed deductions may be:

- Itemized Deductions: actual business expenses

- Optional Standard Deduction (OSD): fixed 40% of gross sales

Taxpayers under graduated income tax are also required to file and pay their percentage tax, equivalent to 3% of their gross sales.

Who Should Consider This?

This system works best if:

- You have high business expenses

- Your business requires equipment, materials, subscriptions, travel, or rentals

- You want to maximize legal deductions

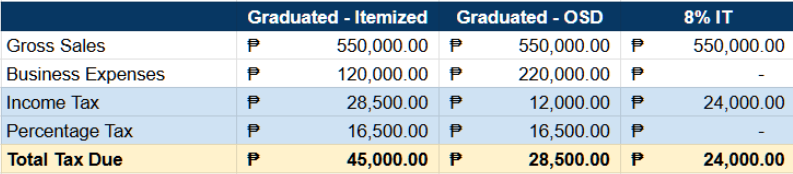

Let’s take a freelance videographer as an example. If the freelancer’s income is ₱550,000 and the business expenses total ₱120,000, his net income will be ₱430,000.

Since the net income is greater than ₱400,000 but less than ₱800,000, the tax due will be computed as follows under itemized deduction:

₱22,500 + (20% x ₱30,000) = ₱28,500

If the same freelancer goes for the optional standard deduction (OSD), his expenses will be 40% of his gross income, equivalent to ₱220,000 (₱550,000 x 40%). His taxes can be computed as follows using OSD:

₱550,000 – ₱220,000 = ₱330,000 (net income)

₱0 + (15% x ₱80,000) = ₱12,000

On top of that, he also needs to pay his percentage tax, computed as:

₱550,000 x 3% = ₱16,500

Based on these examples, the freelance videographer would have a lower tax due if he chose OSD (₱12,000 + ₱16,500) instead of itemized deduction (₱28,500 + ₱16,500).

To decide which of the two is better for you, assess if your business expenses exceed 40% of your gross income.

- Business expenses > 40% of gross income? Itemized deduction

- Business expenses < 40% of gross income? OSD

Note that OSD also comes with the advantage of not needing to itemize all of your business expenses because it relies solely on your gross sales.

Option 2: 8% Income Tax Rate

This option simplifies the tax filing and computations by removing the income brackets and the deductions. Instead, tax due is computed using this straightforward formula:

8% × (Gross Receipts – ₱250,000)

It comes with the following conditions and benefits:

- You cannot deduct expenses

- You cannot use OSD

- You do not file Percentage Tax (3%) anymore

- You pay income tax based strictly on your gross receipts

Who Can Avail the 8%?

Under RMO 23-2018, you may choose 8% only if your total income for the year is below ₱3,000,000 (VAT threshold), you are non-VAT registered, and you are a purely self-employed taxpayer or mixed-income earner (special rules apply).

Let’s take the same freelance videographer as an example. He has ₱550,000 in gross sales. Applying the 8% income tax, his tax due is:

8% x (₱550,000 – ₱250,000) = ₱24,000

Comparing the three options, 8% income tax yields the lowest tax amount due.

But What If You’re a Mixed-Income Earner? (Salary + Freelance)

This part confuses many taxpayers. If you are an employee and a self-employed individual, you are considered a mixed-income earner.

Under this condition, special rules apply. Your salary income is taxed under the graduated rates discussed above. Your business income may be taxed at graduated rates or 8% income tax rates, but if you choose 8%, the ₱250,000 deduction does NOT apply anymore.

This is where filing becomes more complex, so many mixed-income taxpayers choose graduated tax + OSD for simplicity.

When Is the 8% NOT a Good Idea?

Even though 8% is simple, it’s not always cheaper. It’s usually not recommended if:

Your business expenses are high

If you normally spend 30–50% of your income on business expenses, then graduated + itemized deductions might cut your taxable income in half or more.

You might exceed ₱3,000,000 this year

If you cross the ₱3M threshold mid-year:

- You lose 8% eligibility

- You must shift to graduated tax

- You must update registration

- You must compute tax again using graduated brackets

- The 8% you paid earlier is credited but requires recomputation

So if your business is growing fast, it’s safer to stick with graduated + OSD.

How to Choose the 8% Income Tax

You must formally elect the 8% option because it is NOT applied automatically. You can do this by choosing 8% when filing these forms and reports:

- New Business Registration: BIR Form 1901, your First Quarter ITR (1701Q), or your first 2551Q (if applicable).

- Existing Taxpayers: BIR Form 1905, your First Quarter ITR (1701Q), or your first 2551Q (if applicable).

Important: Your choice is good for ONE whole year. Once you elect 8%, you cannot switch to graduated mid-year, you must file 1701Q and 1701 using the 8% method and re-elect 8% every year (it does NOT carry over).

How to Compute Your Taxes (Quick Guide)

8% Income Tax

For PURE self-employed: (Gross Receipts – ₱250,000) × 0.08

For MIXED-income earners: (Gross Receipts) × 0.08

Graduated Income Tax

For Itemized:

Gross Receipts – Actual Expenses = Net Income

Apply TRAIN Tax Table

For OSD:

(OSD) = 40% of Gross Receipts

Net Income = 60% of Gross Receipts

Apply TRAIN Tax Table

Alternatively, you can use this Tax Calculator for an easier, straightforward process.

Which One Should YOU Choose? (Simple Decision Guide)

| Choose 8% Tax if: | Choose Graduated Tax if: |

|---|---|

| ✔ You have HIGH income but LOW expenses ✔ You want the simplest method ✔ You want to avoid filing Percentage Tax ✔ Your income is comfortably below ₱3M | ✔ Your business expenses are large (30%–60%) ✔ You want to deduct equipment, rent, travel, supplies ✔ Your income varies a lot ✔ You’re close to the ₱3M threshold ✔ You want more flexibility (Itemized or OSD) |

Final Thoughts

Both the Graduated Income Tax and 8% Income Tax options are legitimate and effective. The right choice simply depends on your business model.

The key questions to ask yourself are:

- Do I spend a lot for my business?

- Do I want the simplest possible tax system?

- Will my business grow past ₱3M soon?

- Am I comfortable tracking expenses?

If you answer these honestly, you’ll know exactly which tax type fits you.

Related Articles

Leave a Reply