The term “Pag-IBIG Pasalo” pops up a lot in Facebook groups, marketplace listings, and even neighborhood discussions, but very few guides actually explain what it is in a clear, down-to-earth way. If you’ve ever wondered what “pasalo” really means, how it works, and whether it’s safe, this article breaks everything down in simple, real-world terms.

Let’s walk through what Pag-IBIG Pasalo is, how the process works, the risks involved, and the proper way to do it, step by step.

What Exactly Is a Pag-IBIG Pasalo?

“Pasalo” refers to taking over someone else’s loan obligations, usually for a house, townhouse, condo, or lot, because the original borrower can no longer continue paying. It’s like inheriting both the property and the remaining balance.

However, there are two types of pasalo, and this is where many buyers get confused:

1. Informal Pasalo (Private Agreement Only)

This is the most common version you’ll see online. The buyer and seller just agree privately that the buyer will take over the monthly payments. However, Pag-IBIG isn’t involved. The loan isn’t transferred legally. And, even if the document is notarized, Pag-IBIG still considers the original borrower as the responsible party.

This makes informal pasalo risky for both sides.

- No Pag-IBIG approval

- No change of ownership in Pag-IBIG’s records

- Risky for both parties

This is a convenient option, and understandably, the better option for many. Just keep in mind that if you choose this option, secure:

- Deed of Sale with Assumption of Mortgage

- Special Power of Attorney

It is recommended that the SPA be assigned to a close and trusted person by the buyer (e.g., siblings, parents, or friends).

This matters because when it’s time to officially transfer the loan to your name, the person holding the SPA can represent the seller throughout the Pag-IBIG process. That means you won’t have to track down the seller again just to complete the paperwork.

Meanwhile, giving the SPA to the buyer creates a conflict. Pag-IBIG won’t allow someone to act as both the buyer and the seller in the same transaction, so the transfer would not be processed properly.

2. Formal Pasalo via Pag-IBIG Loan Assumption

This is the safe and legitimate route. Here, Pag-IBIG evaluates the new buyer, approves the transfer, and updates their system so the new borrower becomes responsible for the loan. It’s more paperwork, but it’s also the only way to protect your rights.

- Pag-IBIG checks the buyer’s eligibility

- Pag-IBIG approves the assumption

- Loan is officially transferred to the new owner

- Ownership documents are updated

If you’re serious about buying a pasalo property, the second option is the only acceptable route for long-term peace of mind.

Why Sellers Offer Pasalo Deals

People choose to “pasalo” their home for many personal reasons. Usually, these reasons have nothing to do with the property itself and everything to do with life changes.

Common motivations include:

- Relocating for work

- Temporary or long-term financial challenges

- Urgent need for cash

- Changes in family situation

- Upgrading to another property

For sellers, pasalo allows them to avoid foreclosure and exit the loan without damaging their credit.

Why Buyers Look for Pasalo Properties

Buyers are drawn to pasalo because it can be more flexible and affordable compared to buying a brand-new home. A few key advantages include:

- Lower initial cash-out

- Faster move-in (many pasalo units are already occupied or ready for occupancy)

- No need to wait for pre-selling units

- Monthly payments are already established

- Some properties are in fully developed communities

It gives buyers an opportunity to “step in mid-way” instead of starting from zero.

Is Pag-IBIG Pasalo Legal?

Yes, as long as the transfer goes through Pag-IBIG.

Informal or “private” pasalo deals, even with a notarized deed, do not count as legal ownership transfers in the eyes of Pag-IBIG.

This means the seller still holds the official responsibility for the loan, and the buyer has no legal protection if anything goes wrong. Only the formal assumption process recognized by Pag-IBIG makes the pasalo safe.

How the Official Pag-IBIG Pasalo Process Works

To keep things easy to follow, here’s a simple overview of how the legitimate loan assumption process usually goes. Before anything else, the buyer should first verify the property’s status.

Step 1. Check the Property and Seller’s Account

Ask the seller for:

- Updated payment records

- Statement of account

- Proof that amortizations are up to date

- Basic property documents (Transfer Certificate of Title (TCT), Contract to Sell from Pag-IBIG, etc.)

- Reason for selling

This filters out risky or problematic deals early. Note that Pag-IBIG can only proceed with this process if the title of the property has already been assigned to the seller.

Step 2. Apply for Loan Assumption at Pag-IBIG

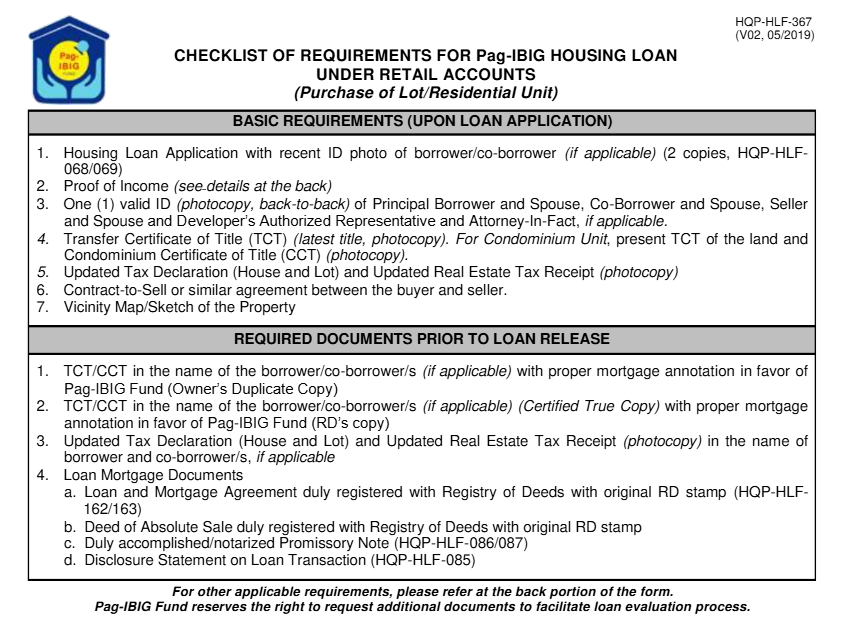

The buyer submits requirements similar to a regular housing loan application. As of writing, Pag-IBIG requires the following documents:

There is also a processing fee of Php1,000 and an appraisal fee of Php2,000.

3. Pag-IBIG Evaluates the Buyer

They will verify:

- Your capacity to pay

- Your credit standing

- The property’s legal status

- The seller’s account

If everything checks out, Pag-IBIG issues a Letter of Approval.

4. Signing of Documents

Once approved, both parties sign:

- Deed of Assignment (with Special Power of Attorney if needed)

- Updated loan documents

- Pag-IBIG’s official contract for loan transfer

5. Pag-IBIG Updates Their Records

After processing:

- You become the new borrower of record

- You legally take over the loan

- All payments and responsibilities move under your name

This is the step that makes the transfer legitimate and safe.

How Much Does a Pasalo Typically Cost?

A pasalo deal is often more affordable than a regular purchase, but you should still expect some costs. The buyer typically pays two main things:

- Takeover amount (seller’s equity or total paid amortizations)

- Processing fees such as documentation, notarization, and sometimes transfer fees

Costs vary widely, so always request a full breakdown of the seller’s payments and remaining loan balance.

Risks Involved and How to Avoid Them

Pasalo can be safe if done properly, but it comes with risks if you take shortcuts. The biggest threats usually appear in informal or undocumented setups.

Some risks include:

- Seller backing out later

- Hidden arrears or unpaid dues

- Loan still under seller’s name even after years of payment

- Legal disputes involving the seller or property

To minimize risks:

- Only transact through Pag-IBIG

- Avoid deals where sellers refuse to meet at Pag-IBIG

- Verify the account yourself, not only through the seller

- Keep copies of all receipts and documents

Some deals may sound too good to pass up, but if a seller insists that a notarized document is enough, or claims “Pag-IBIG won’t know as long as you pay,” consider it a serious red flag.

Is Pasalo for You?

Pasalo can be a smart move if you’re looking for a ready-for-occupancy home or if you want to minimize upfront costs. It can also be ideal if you’re comfortable taking over an existing mortgage rather than applying for a brand-new one.

However, if the documents are unclear, if your income is unstable, or if the seller refuses Pag-IBIG involvement, it’s better to look elsewhere. Property ownership is a long-term commitment; you want your foundation to be solid from the start.

Taking shortcuts may seem tempting in the moment, but the security and peace of mind you get from a legitimate transfer are always worth the extra steps.

Related Articles:

Leave a Reply