Starting your investment journey in the Philippines can feel overwhelming at first, parang ang daming kailangan intindihin, right? But honestly, it’s much more doable than you might think. In 2025, with so many accessible platforms, financial tools, and government programs available, investing has become more reachable para sa ordinaryong Pilipino. Whether your goal is to grow your savings, prepare for retirement, or simply build wealth over time, the first step is understanding how investments work and how you can start safely.

In this guide, I’ll walk you through the essentials of how to start investing in the Philippines this 2025, step by step, like a friend guiding you along.

- How to Invest for Beginners in the Philippines

- Why is investing important in 2025?

- What is the difference between saving and investing?

- How Much Money Do I Need to Start Investing in the Philippines?

- Where Can I Invest My Money in the Philippines?

- How to Choose Where to Invest

- How do you start investing in the Philippines in 2025?

- Tips on Investment for Beginners in the Philippines

- Micro Guide: How do you actually start investing on different platforms (scroll for more)?

- What common mistakes should you avoid when investing?

- Is it worth starting your investing journey in 2025?

How to Invest for Beginners in the Philippines

Starting to invest as a beginner is all about building a strong foundation. First, you have to understand that investing isn’t just for the rich — it’s for anyone willing to be patient and learn. Even with a few hundred pesos, you can begin. It starts with learning basic investment concepts, setting financial goals, and choosing the right platform where you feel comfortable putting your money.

Why is investing important in 2025?

Imagine working so hard every month and simply letting your money sleep in a savings account with less than 1% interest. Meanwhile, inflation (currently hovering around 2.2% as of early 2025 based on BSP reports) continues eating away at your purchasing power. Hindi ba sayang?

Investing is no longer just a “pang-mayaman” thing. It’s a practical move to make your money work for you. Even with just a few thousand pesos, you can already start laying the groundwork for your future. Think of it as planting seeds — the earlier you start, the more chances your small beginnings will grow into something bigger.

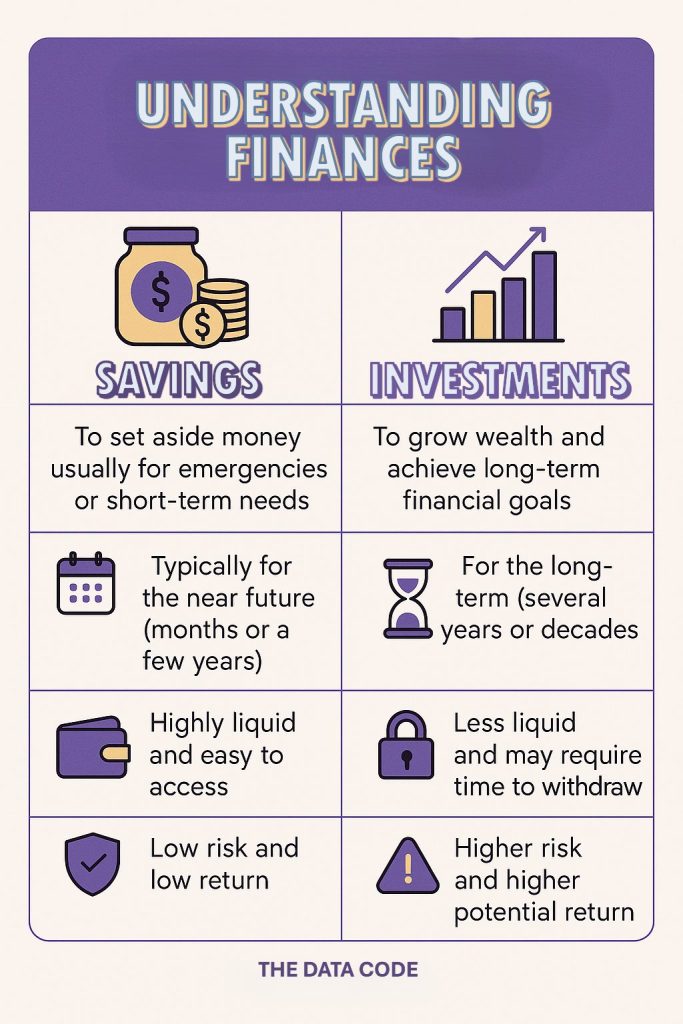

What is the difference between saving and investing?

Let’s clear this up real quick:

Savings is parking your money somewhere safe (usually a bank), ready for emergencies or short-term needs.

Investments, on the other hand, involve putting your money in something that can grow in value over time, like stocks, bonds, real estate, or mutual funds, but with some risk.

Saving keeps your money safe; investing helps it grow. Kaya ideally, you do both.

How Much Money Do I Need to Start Investing in the Philippines?

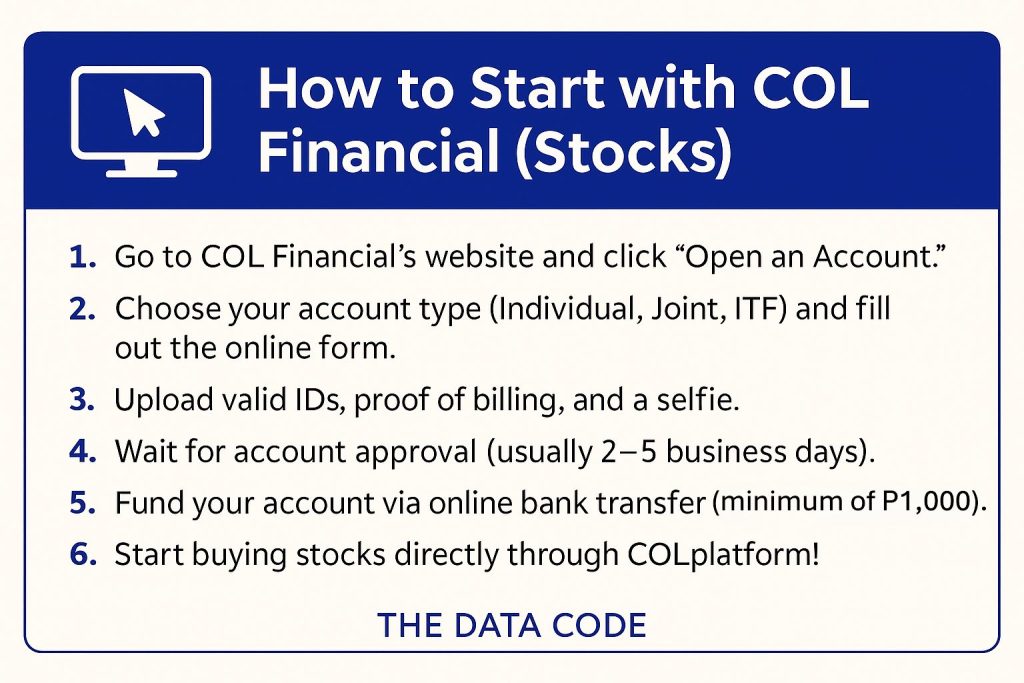

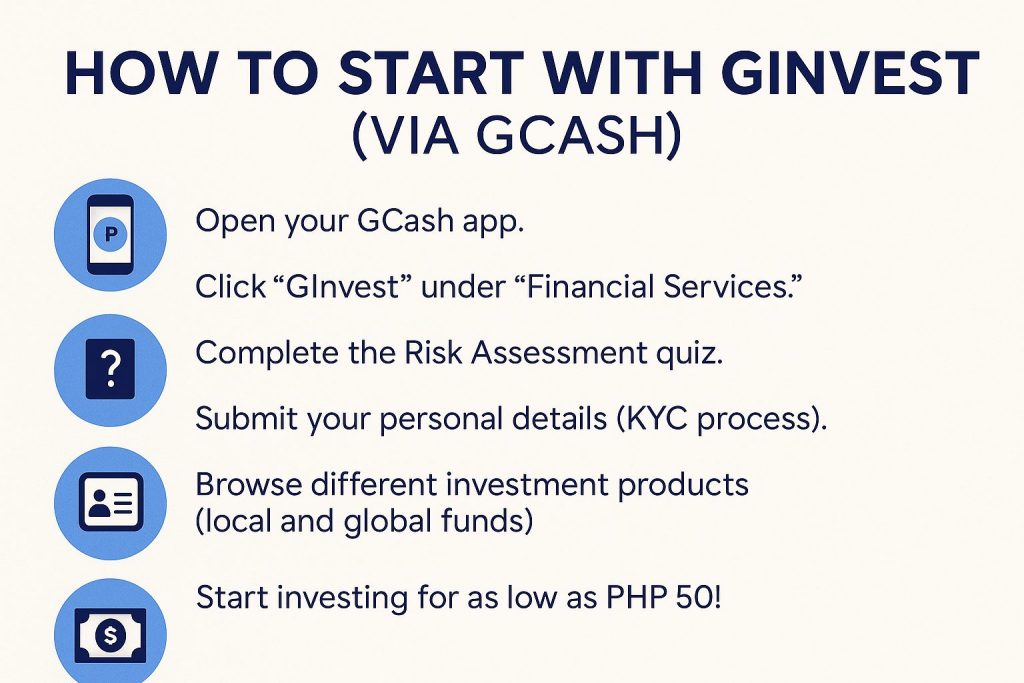

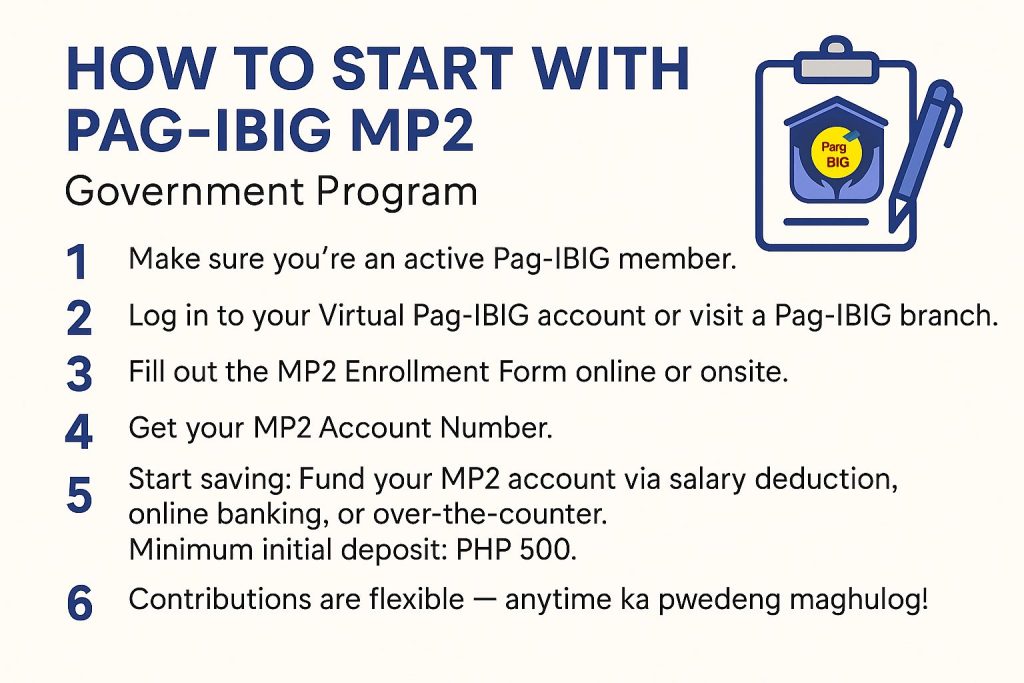

Good news: Hindi kailangan ng milyon para makapagsimula. You can start investing in the Philippines for as low as PHP 50 through platforms like GCash’s GInvest. Some traditional stockbrokers like COL Financial require a minimum of PHP 1,000 to open an account. For government programs like Pag-IBIG MP2, you can start with just PHP 500. The key here is consistency, not the size of your first investment.

Where Can I Invest My Money in the Philippines?

In the Philippines, these are the common starting points if you’re just getting into investing. Let’s go through them one by one:

Common Trading Platforms

If you’re looking to start investing in the stock market or pooled investment products, here are some popular trading platforms:

COL Financial — One of the leading online stockbrokers in the Philippines, COL Financial is beginner-friendly and allows you to start investing in Philippine stocks with as little as ₱1,000.

AAA Equities – One of the longest-running and trusted online stockbrokers in the Philippines, AAA Equities offers competitive commission rates and access to a user-friendly online trading platform. Suitable for beginners and active traders alike.

First Metro Sec — Great for Metrobank clients and those looking for bundled investment products. They also offer a First Metro Sec Go mobile app for easy investing. [Guide coming soon]

BDO Securities — Perfect for those who already have a BDO account, BDO Securities offers access to a range of local and international investment products. [Guide coming soon]

BPI Trade — Designed for BPI account holders, BPI Trade provides seamless integration between your savings account and your trading activities. [Guide coming soon]

GInvest (via GCash) — One of the easiest ways to start investing for beginners. Through GCash’s GInvest, you can invest in local and global mutual funds for as low as ₱50. [Guide coming soon]

Government Investment Programs

If you want safer, lower-risk investments backed by the government, here are some trusted options:

- Pag-IBIG MP2 — A voluntary savings program offering higher dividends compared to regular savings. Perfect for conservative investors looking to grow their money safely.

- SSS WISP Plus — A voluntary provident fund by SSS aimed at helping members build a bigger retirement fund on top of their mandatory contributions.

Both programs are ideal if you want steady, relatively safer returns without dealing with the daily ups and downs of the stock market.

Bonds

- Government Bonds — These are debt securities issued by the Philippine government. Retail Treasury Bonds (RTBs) are popular because they are low-risk and usually offer higher returns than traditional savings accounts.

- Corporate Bonds — Companies also issue bonds to raise capital. These typically offer higher returns compared to government bonds but come with slightly more risk.

You can invest in bonds through local banks like BPI, Metrobank, or through online brokers that allow bond trading.

Real Estate Investment Trusts (REITs)

If you want to invest in real estate without the hassle of owning property, REITs are a good option. You earn dividends from real estate companies without needing to manage buildings yourself.

Some popular REITs listed on the Philippine Stock Exchange include:

- AREIT (Ayala Land)

- MREIT (Megaworld)

- RCR (Robinsons Land)

You can invest in REITs through the same stock trading platforms mentioned earlier.

How to Choose Where to Invest

Choosing where to invest boils down to understanding three important things:

- Your Financial Goals — Are you investing for a short-term goal (like a vacation) or long-term (like retirement)? Stocks and equity funds suit long-term goals, while bonds and MP2 programs are better if you need safer, short-to-medium-term options.

- Your Risk Appetite — How comfortable are you seeing your money fluctuate? Kung hindi ka sanay sa ups and downs, mas bagay sa’yo ang low-risk instruments like bonds or Pag-IBIG MP2. Pero kung kaya mo ang volatility for higher potential gains, stocks and equity funds are worth considering.

- Your Investment Timeline — Longer timelines give you more freedom to take risks since you have time to recover from market dips. Short timelines mean you should prioritize safer options.

Hindi mo kailangang pumili ng isa lang. You can diversify by combining different types of investments.

How do you start investing in the Philippines in 2025?

Check your financial health

Before jumping in, tanungin mo muna sarili mo: “Okay ba finances ko?” Do you have emergency savings (around 3–6 months’ worth of expenses)? May utang ka ba na kailangang bayaran? Investments involve risk, and hindi siya dapat pang-taya ng emergency money.

If you’re financially stable, let’s go to step two!

Set clear investment goals

Ano bang goal mo? Retirement? Buying a house? Preparing for your future family? Setting goals will guide what type of investments fit your needs. For example, if you plan to buy a condo in 3 years, baka hindi bagay ang super volatile investments like pure stocks.

Pro tip: Assign “time horizons” sa goals mo. Short-term (less than 5 years), medium-term (5–10 years), or long-term (more than 10 years).

Choose the right investment vehicle

Based on your goals, pick the right type of investment. Stocks for growth? Bonds for safety? A mix of both? Hindi kailangan pumili ng isa lang — you can diversify even with small amounts.

Start small but be consistent

Many investments allow you to start with PHP 1,000 or even less. Don’t stress about making “big time” investments immediately. It’s better to start small but regularly, monthly, quarterly, whatever works para sa ‘yo.

In fact, a lot of online platforms now allow automatic investing (“auto-debit” style), so hindi mo na kailangan mag-isip each time.

Monitor, learn, and adjust

Once you start, hindi ibig sabihin pabayaan mo na. Check your investments at least once a quarter. Are you on track with your goals? If not, baka kailangan ng adjustments — like adding more funds or tweaking your allocations.

And habang nag-iinvest ka, continue learning. Attend free webinars, read financial blogs (hi, welcome!), and don’t be afraid to ask experts.

Tips on Investment for Beginners in the Philippines

Here are practical tips para mas maging smooth ang investment journey mo:

- Start ASAP — Time is your best friend when investing. The earlier you start, the more time compounding can work in your favor.

- Invest Consistently — Kahit maliit na amount monthly, basta tuloy-tuloy, it will add up over the years.

- Diversify Your Portfolio — Don’t put all your eggs in one basket. Spread your money among stocks, bonds, mutual funds, and government savings programs.

- Reinvest Earnings — If you receive dividends or interest, reinvest them instead of cashing out agad.

- Stay Informed and Patient — Investing is a marathon, not a sprint. Read updates, attend webinars, but don’t get swayed by hype or panic.

Micro Guide: How do you actually start investing on different platforms (scroll for more)?

What common mistakes should you avoid when investing?

Hindi lahat ng “kumikita” agad magaling. Here are a few common pitfalls na kailangan mong iwasan:

| Mistake | Bakit Mali? |

|---|---|

| Chasing “get-rich-quick” schemes | Usually scams or extremely high-risk. Legit investments take time. |

| Investing without research | Investing in something you don’t understand is like driving blindfolded. |

| Emotional investing | Don’t panic when prices drop; it’s normal. Stick to your plan. |

| Not diversifying | Putting all your money sa isang investment = high risk. |

| Ignoring fees | Some investments have management or transaction fees that eat into your gains. |

Is it worth starting your investing journey in 2025?

Starting to invest might feel intimidating at first, pero once you build the habit, you’ll realize it’s one of the smartest decisions you’ll ever make. Kahit maliit lang ang panimula mo today, compounding growth (“tubò sa tubò”) will reward you in the long run.

Don’t wait until “handa na ako” or “malaki na ipon ko.” Start where you are now — with what you have.

Tandaan: Hindi mo kailangang maging finance expert to secure your future. You just need the willingness to learn, patience to wait, and courage to take the first step.

Kaya mo ‘yan, friend. Let’s make 2025 the year you start building wealth for your future!

Disclaimer: This guide is for educational purposes only. Please do your own research or consult a licensed financial advisor before making investment decisions.

Related Posts: