If you’ve been thinking about investing in Philippine stocks, chances are you’ve come across COL Financial Philippines. It’s one of the most popular online stockbrokers in the country—but is it really worth it? In this guide, we’ll walk through what COL Financial is, how it works, its pros and cons, and what you need to know before you dive in.

- What is COL Financial?

- How Does COL Financial Work?

- How to Open a COL Financial Account (2025 Updated)

- Types of Accounts You Can Open

- COL Financial Fees and Charges (2025)

- COL Financial Trading Hours

- Pros and Cons of Using COL Financial

- Is COL Financial a Good Choice for Beginners?

- COL Financial vs Other Platforms (Quick Look)

- Tips for New COL Financial Users

- Directory

- Final Thoughts

- FAQs about COL Financial Philippines (2025)

What is COL Financial?

COL Financial is an online stock brokerage firm that allows Filipinos to buy and sell stocks, bonds, and mutual funds directly through the Philippine Stock Exchange (PSE). Established in 1999, it has built a strong reputation, especially among beginner and retail investors.

Think of COL Financial as your middleman. Instead of physically going to the PSE or dealing with tons of paperwork, you can just log into your account, kahit nasa bahay ka lang, and start investing.

As of 2025, COL Financial still ranks among the top brokers by the number of active clients in the country. According to their 2024 financial report, COL Financial serves 553,098 Filipino traders.

How Does COL Financial Work?

When you open an account with COL Financial, you get access to their trading platform. This is where you can:

- Buy and sell stocks listed in the PSE

- Invest in mutual funds through the COL Fund Source

- Track your portfolio in real time

- Research stocks using COL’s market reports and analysis

Essentially, you fund your COL account (parang e-wallet) and use that money to buy investments. Every transaction you make, buying or selling, will reflect in your account instantly.

How to Open a COL Financial Account (2025 Updated)

Opening an account now is even more convenient than before. Here’s a simple overview of the process:

- Visit the official COL Financial website and click “Open a COL account online.”

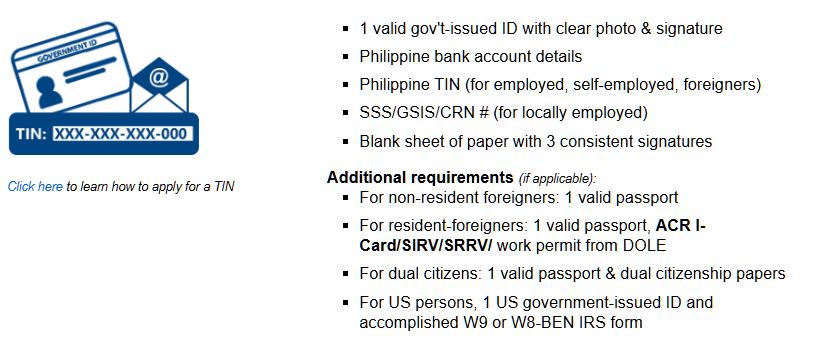

2. Prepare your documents: government-issued ID, bank account details, and TIN/SSS/GSIS number.

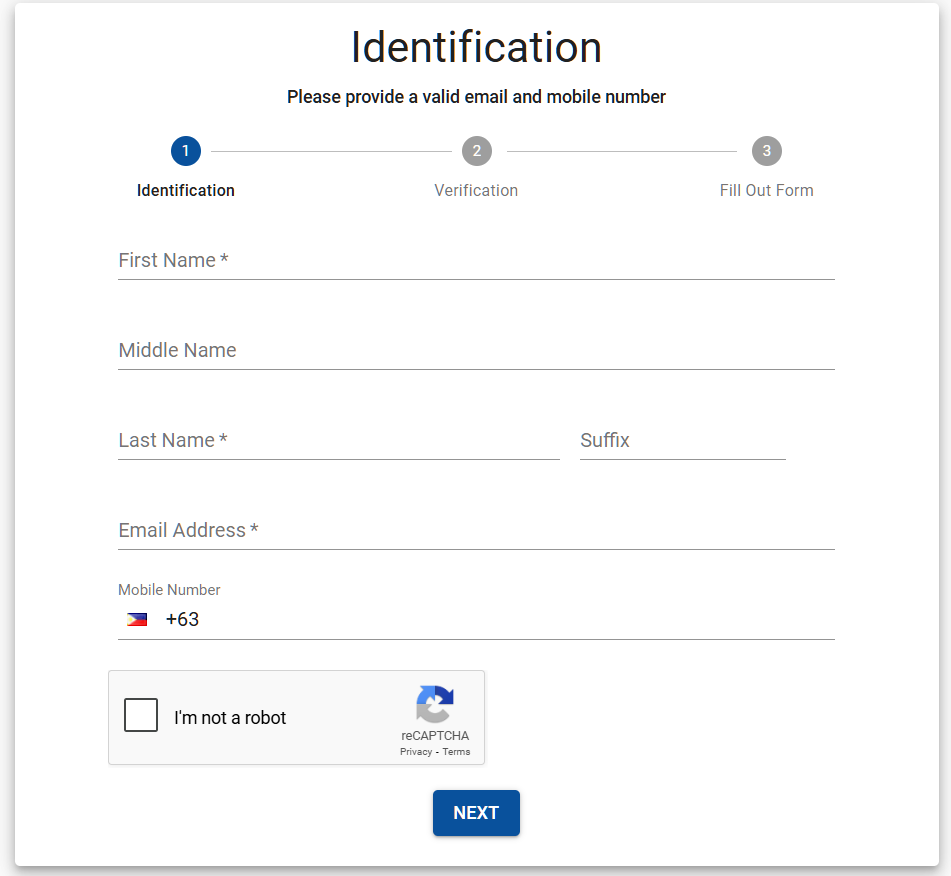

3. Fill out the online application form. Make sure to use an active email address and mobile number because you need to verify them before you can proceed.

4. Choose Individual for the Account Type and complete filling up the required information.

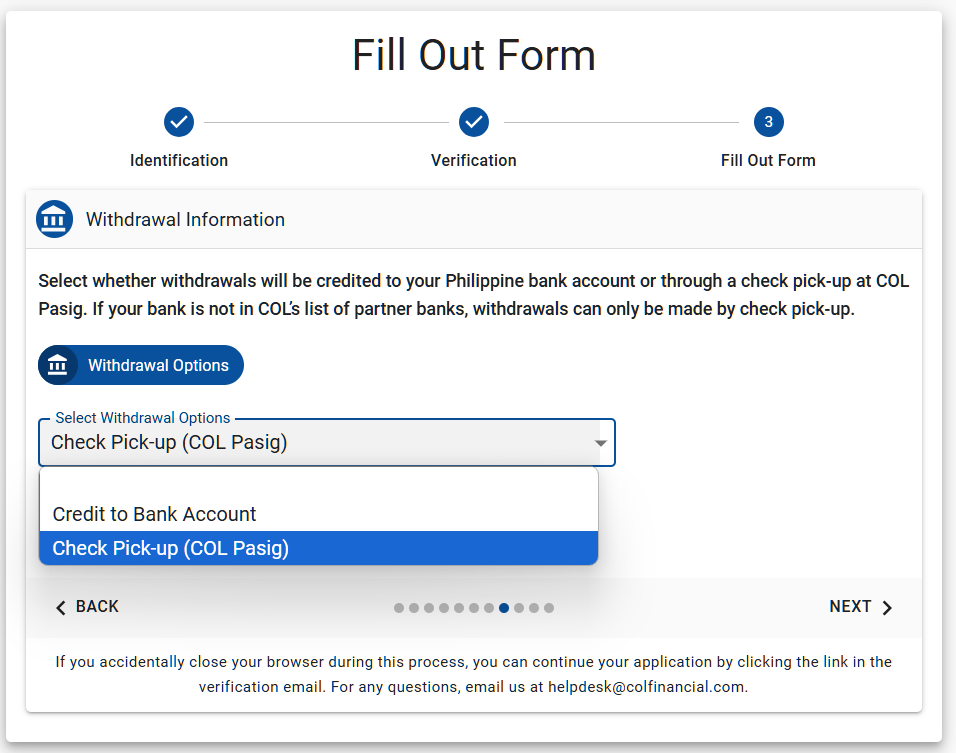

5. For withdrawal options, you can choose to have funds deposited into your bank account. You have to provide your bank details for this option. You can also opt for a check pick-up at the COL office located in Pasig City.

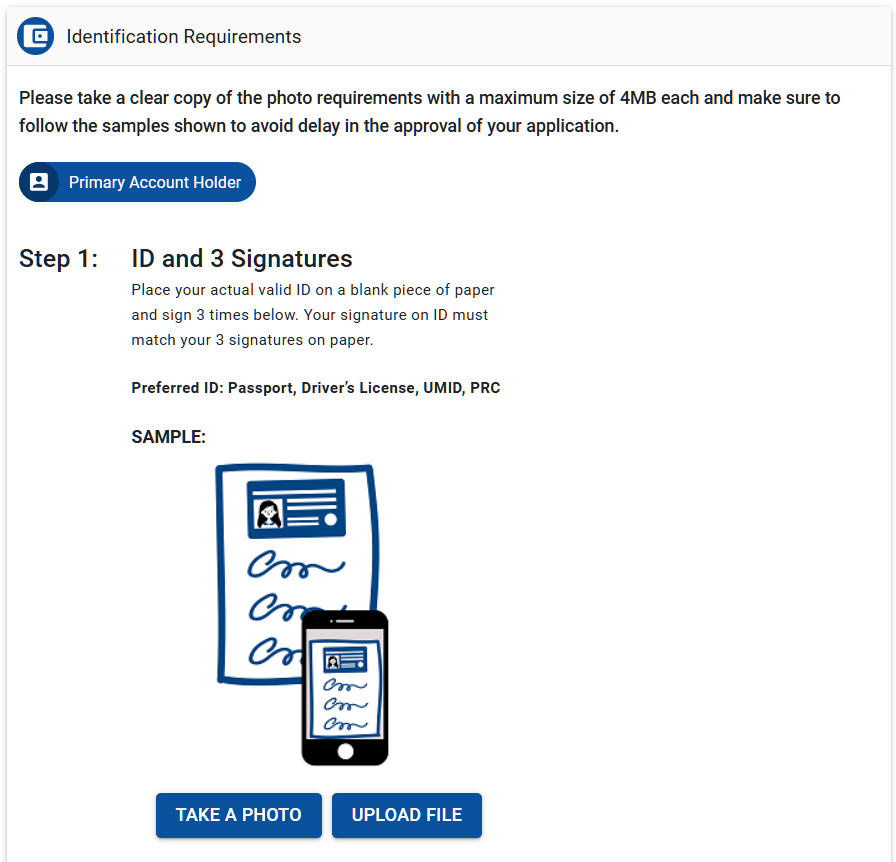

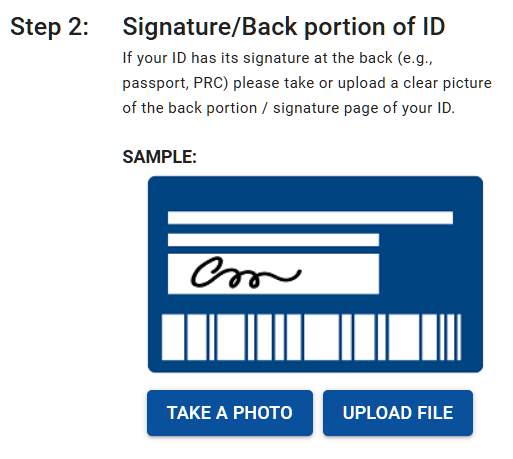

6. Complete the identification requirements. You have to prepare a blank sheet of paper, a valid government-issued ID, and yourself for the selfie and video verification. Finalize and submit.

7. Wait for the confirmation email from COL Financials. Once approved and created, start funding your account for a minimum of P1,000.

Good news! As of this year, COL has also partnered with GCash and Maya for easier funding. Kaya kung sanay ka mag-GCash, madali na mag-top up.

Types of Accounts You Can Open

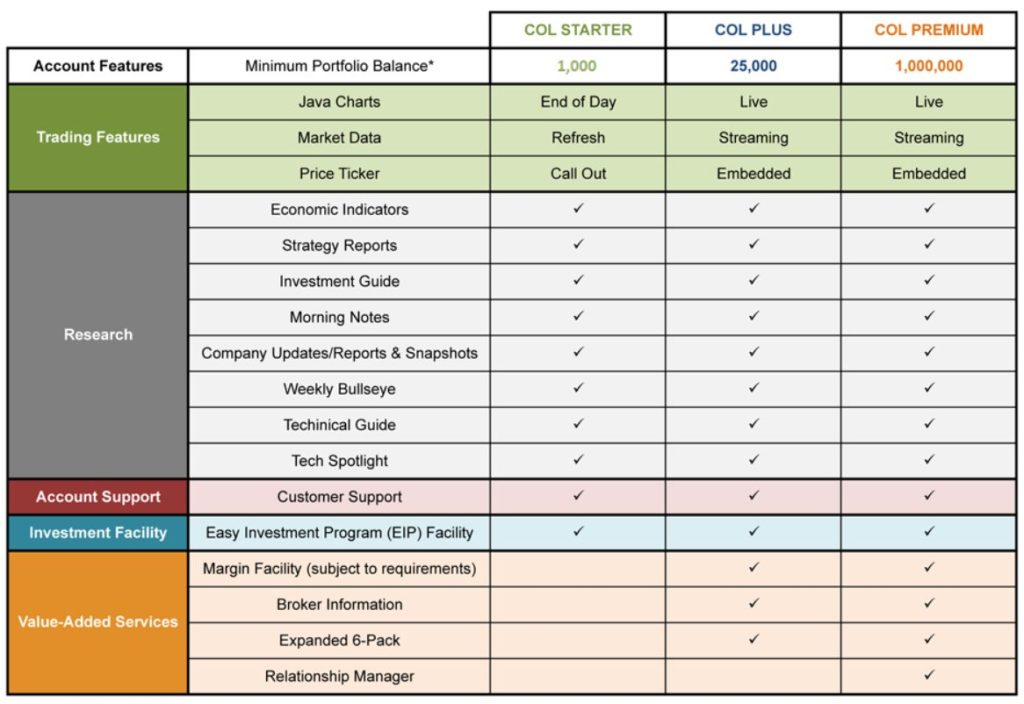

COL Financial offers three account types: COL Starter, COL Plus, and COL Premium.

- COL Starter is for beginners requiring basic access to the platform. It requires a minimal initial deposit of Php 1,000.

- COL Plus is for active traders requiring real-time data and detailed research. The minimum initial deposit is Php 25,000.

- COL Premium is the most advanced account for high-net-worth individuals requiring priority support. Its minimum initial deposit is Php 1,000,000.

The complete features of each tier are shown below.

Most newbies (probably like yourself) start with the COL Starter account and upgrade later on if needed.

COL Financial Fees and Charges (2025)

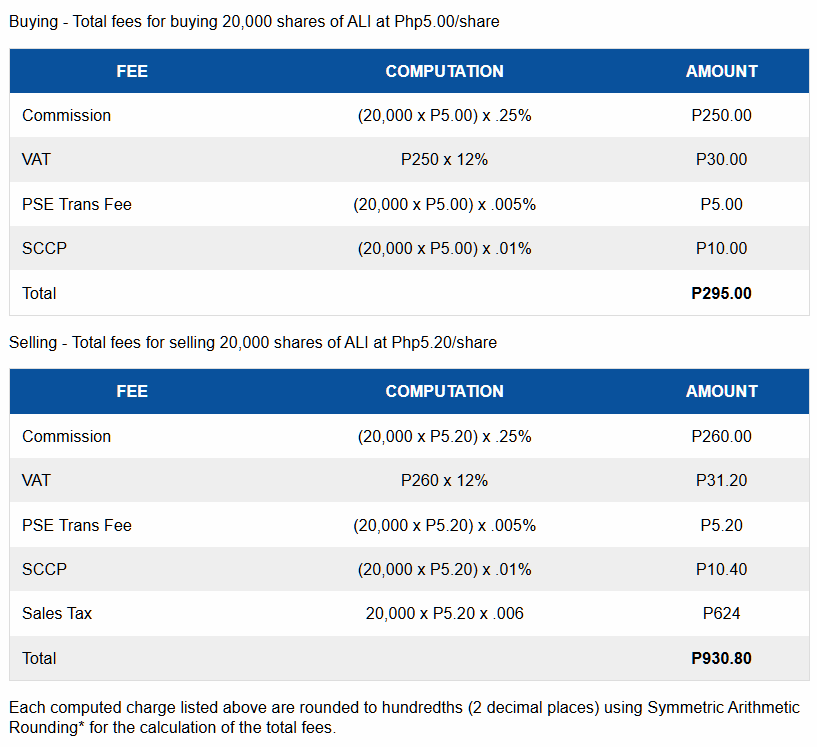

Before you start investing, it’s good to be aware of COL Financial’s fees and charges:

| Transaction | Fee |

|---|---|

| Buying/Selling Stocks | 0.25% of the gross trade amount |

| VAT | 12% of the broker’s commission |

| PSE Transaction Fee | 0.005% of gross trade amount |

| SCCP Fee | 0.01% of gross trade amount |

| Sales Tax (on selling only) | No. of Shares x Price x 0.006 |

May konting bawas sa bawat buy or sell, but that’s standard across all brokers regulated by the PSE.

Here are some sample fee tables taken from the COL Financial website.

COL Financial Trading Hours

Trading on COL Financial follows the standard schedule set by the Philippine Stock Exchange (PSE), which is Monday to Friday, 9:00 AM to 3:30 PM. Here’s how the trading day is structured:

| Time | Period | Actions Allowed |

|---|---|---|

| 9:00 AM | Pre-Open Period | You can enter orders, but can no longer cancel or modify them. |

| 9:15 AM – 9:30 AM | Pre-Open No-Cancel Period | Orders are automatically matched at the best price. Odd lots can also be traded during this period. |

| 9:30 AM | Opening Period | The opening price for all securities is calculated. Orders are frozen momentarily while the opening price is determined. |

| 9:30 AM – 12:00 NN | Continuous Trading | Matching is paused. From 3:15 to 3:17 PM, you can enter, modify, or cancel orders. From 3:18 – 3:20 PM, no cancellations are allowed. |

| 12:00 NN – 1:30 PM | Market Recess | Trading is paused. |

| 1:30 PM | Market Resumes | Trading resumes after the break. |

| 3:15 PM – 3:20 PM | Pre-Close Auction Period | Matching is paused. From 3:15 to 3:17 PM, you can enter, modify, or cancel orders. From 3:18 to 3:20 PM, no cancellations are allowed. |

| 3:20 PM – 3:30 PM | Run-Off/Trading-At-Last | You can only enter buy or sell orders at the closing price. |

| 3:30 PM | Market Close | Trading for the day officially ends. |

Staying aware of the trading hours is crucial for investors, especially those who want to capitalize on market openings and closings. Keep an eye on these time slots to plan your trading strategies effectively.

Pros and Cons of Using COL Financial

No platform is perfect, diba? Here’s a balanced view.

Pros:

- Reputable and trusted: More than two decades in the business.

- User-friendly platform: Great for beginners.

- Educational resources: Free webinars and tutorials.

- Access to mutual funds: You can diversify easily.

- Convenient online transactions: No need to visit offices.

Cons:

- Sometimes, the platform slows down, especially during peak hours (like pag biglang may IPO or market crash)

- Limited mobile app features compared to newer apps

- Higher commission rate compared to some digital-only brokers

Is COL Financial a Good Choice for Beginners?

Honestly, yes, especially if you prefer a tried-and-tested platform. COL Financial’s interface may look a bit old-school compared to apps like GCash Invest Money or Seedbox, but it’s reliable and backed by a ton of educational resources.

If you’re serious about learning the basics of stock investing, COL makes it easy to start. Pero kung mas trip mo ang super-simplified apps with lower fees, you might want to compare a few options first.

COL Financial vs Other Platforms (Quick Look)

| Broker | Minimum Deposit | Strength |

|---|---|---|

| COL Financial | Php 1,000 | Long-term reputation, research tools |

| FirstMetroSec GO | Php 1,000 | Seamless Metrobank integration |

| BPI Trade | None, with a maintaining balance of Php 500 | BPI account-linked investing |

| GCash GInvest | Php 50 | Beginner-friendly, lower starting capital |

As you can see, if you’re after credibility and full investing features, COL Financial is hard to beat.

Tips for New COL Financial Users

- Start small: Kahit Php 1,000 lang muna. Don’t invest your emergency fund.

- Attend COL webinars: Very useful for learning.

- Diversify: Wag lahat ng pera sa isang stock lang.

- Patience is key: Stock investing is a long game, not a get-rich-quick scheme.

Directory

COL Financials Office Addresses:

- Luzon: 24/F East Tower, Tektite Towers, Exchange Road, Ortigas Centre, Pasig City

- Visayas: 3F-06 One Montage, Archbishop, Reyes Avenue Brgy. Kamputhaw, Cebu City

- Mindanao: 2/F Robinsons Cybergate, J.P. Laurel Avenue, Bajada, Davao City

COL Financials Email Addresses:

- Main Office: helpdesk@colfinancial.com

- Cebu Office: colcebu@colfinancial.com

- Davao Office: coldavao@colfinancial.com

COL Financials Contact Number: (02) 8636-5411

COL Financials Fax Number: (02) 8634-6958

COL Financials Office Hours: Mon-Fri, 9:00 AM – 4:00 PM

Final Thoughts

Choosing your first stockbroker is a big step, and COL Financial Philippines continues to be a strong choice in 2025. It’s reliable, educational, and made with Filipino investors in mind. If you want a platform where you can learn the ropes and grow your portfolio at your own pace, COL is definitely worth considering.

Pero syempre, the best investment is still in your own education. The more you learn, the smarter your financial decisions will be. Kaya go lang—start small, keep learning, and enjoy the journey!

FAQs about COL Financial Philippines (2025)

1. Is COL Financial legit and safe?

Yes, COL Financial is licensed and regulated by the Philippine Stock Exchange (PSE) and the Securities and Exchange Commission (SEC). Your funds are held under your name, and the platform complies with investor protection rules from the BSP and PSE.

2. What is the minimum deposit to open an account?

The minimum starting capital is Php 1,000 for a COL Starter account. You can add more funds anytime after that.

3. Can I open a COL Financial account even if I’m an OFW?

Yes, OFWs can open an account online. Just make sure to submit valid documents, including a government-issued ID and proof of billing (kahit overseas).

4. Do I need to be an expert in stocks to use COL Financial?

Nope! The platform is designed with beginners in mind. It even includes educational materials, webinars, and stock recommendations for those starting out.

5. How do I withdraw money from my COL Financial account?

You can request a withdrawal online through your COL dashboard. The funds are deposited into your nominated bank account, usually within 1–2 business days.

6. Are there alternatives to COL Financial?

Yes. Other options include FirstMetroSec, BPI Trade, GInvest, and AB Capital. Each has its pros and cons, so it depends on your preferences.

7. What happens if COL Financial shuts down?

Your investments are not held by COL itself but by a custodian bank and recorded under your name. In case of closure, regulators and partner banks ensure proper transition or liquidation.