Looking for a solid stockbroker that’s beginner-friendly and packed with smart features? AAA Equities might be your best bet in 2025. It’s becoming a top choice for Filipinos who want a platform that’s affordable, easy to use, and, most importantly, designed to help protect their investments through smart tools like conditional orders.

In this guide, we’ll walk you through what AAA Equities offers, how to open an account, updated requirements, features, pros and cons, fees, and how it compares to other online brokers in the Philippines.

So, is AAA Equities the right broker for you? Let’s dive deeper, with real talk, practical examples, and updates you’ll actually find helpful.

- What is AAA Equities?

- How to Open an AAA Equities Account (Step-by-Step)

- AAA Equities Fees: Lower Cost, More Gains?

- Conditional Orders and Cutting Losses on AAA Equities

- Platform: User Experience on Web and Mobile

- Pros and Cons (Updated for 2025)

- AAA Equities vs Other Online Brokers (2025 Comparison)

- Directory

- Final Thoughts: Should You Open an AAA Equities Account in 2025?

What is AAA Equities?

AAA Equities is an online stock brokerage firm licensed under the Philippine Stock Exchange (PSE) and Securities and Exchange Commission (SEC). It’s been around since 1989, although for a long time, it operated more in the background compared to giants like COL Financial. In recent years, it’s gained traction for doing something most other platforms in the country haven’t really prioritized, offering conditional trading features, better UI, and tech-savvy tools for serious investors.

It’s designed for people who want access to both web and mobile trading, and its trading interface is one of the most modern-looking among Philippine brokers. If you’ve used COL Financial before, you’ll notice AAA’s interface feels more advanced and intuitive, something many younger and tech-comfortable Pinoy investors appreciate.

How to Open an AAA Equities Account (Step-by-Step)

Everything can be done online, and their system is quite fast.

1. Go to AAA Equities’ website. Click Sign Up.

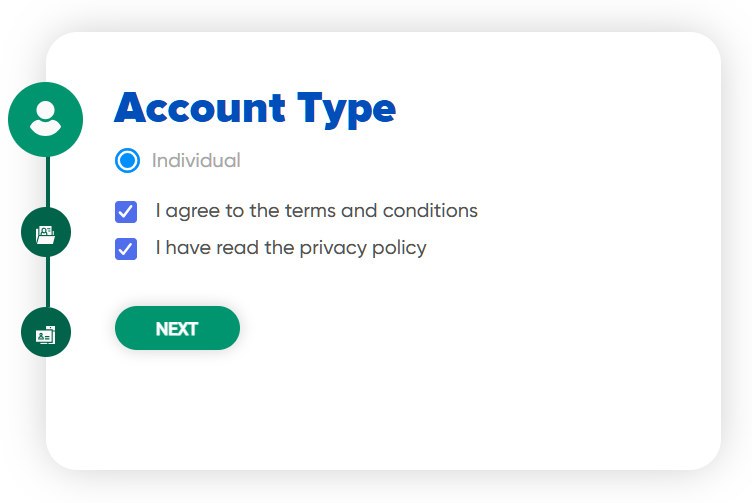

2. Choose Individual as your account type and agree to the terms and conditions.

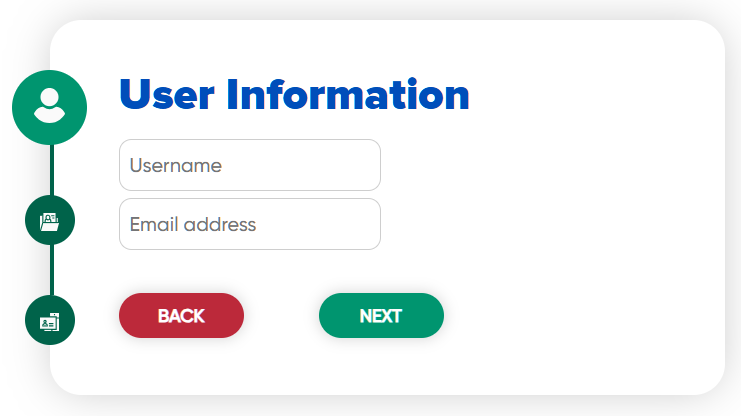

3. Nominate your username and input an active email address.

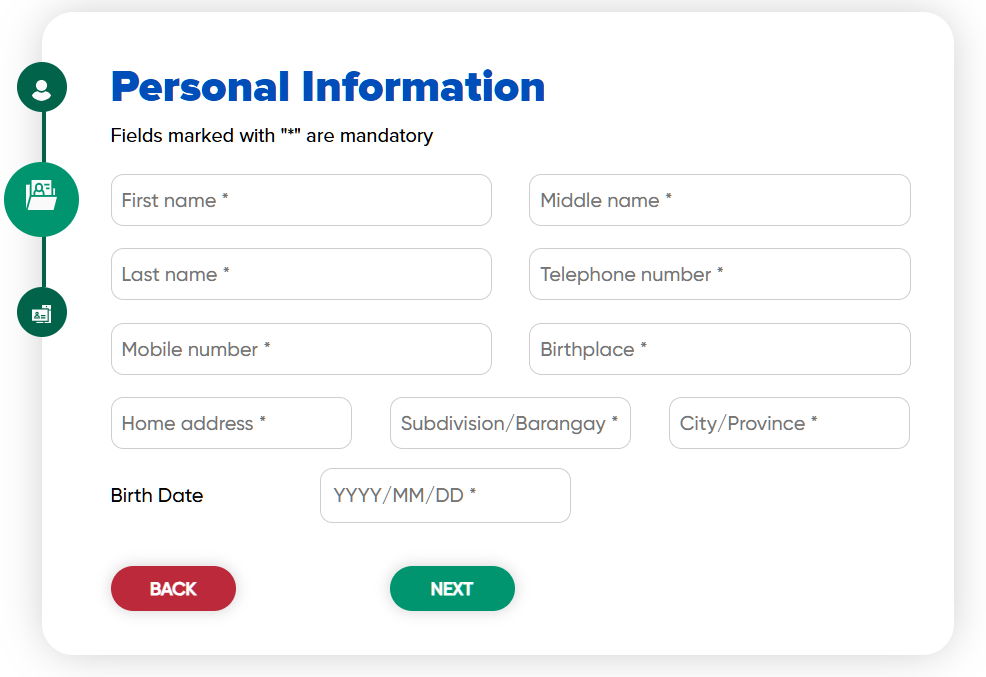

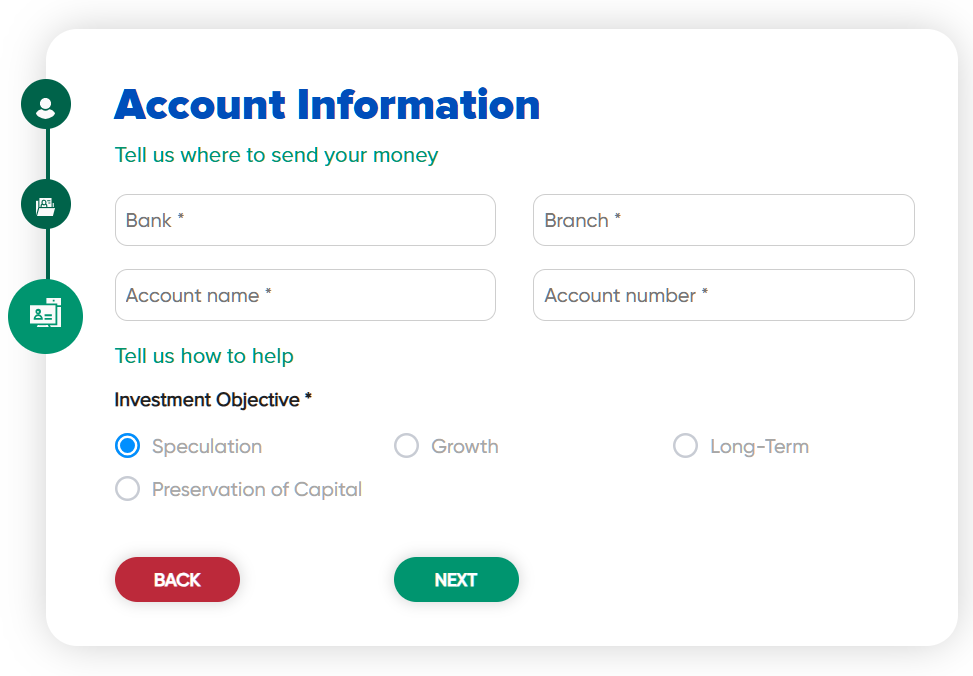

4. Input your personal and financial details. For a more personalized experience, choose your investment objective.

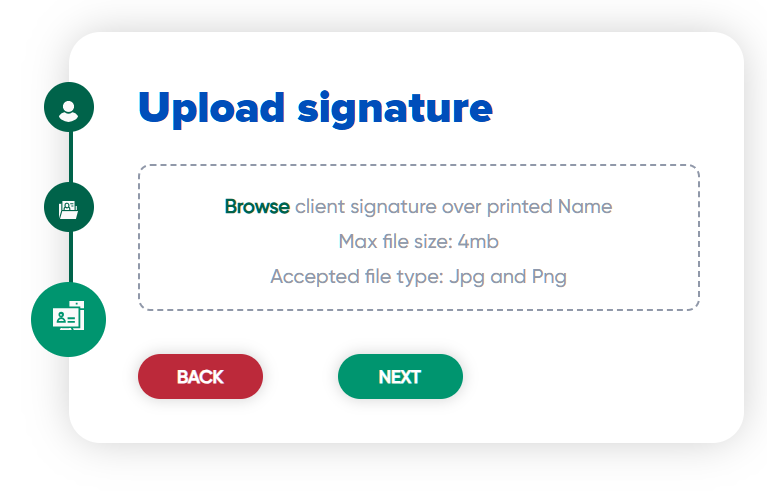

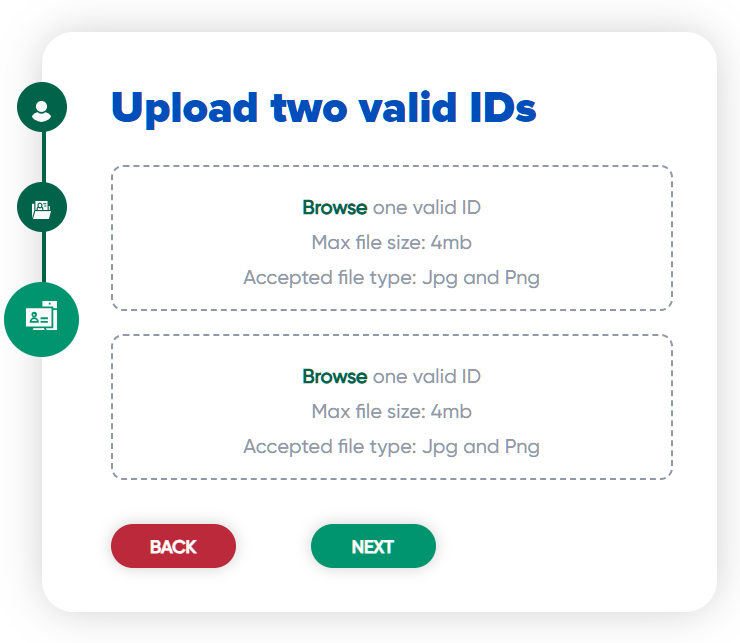

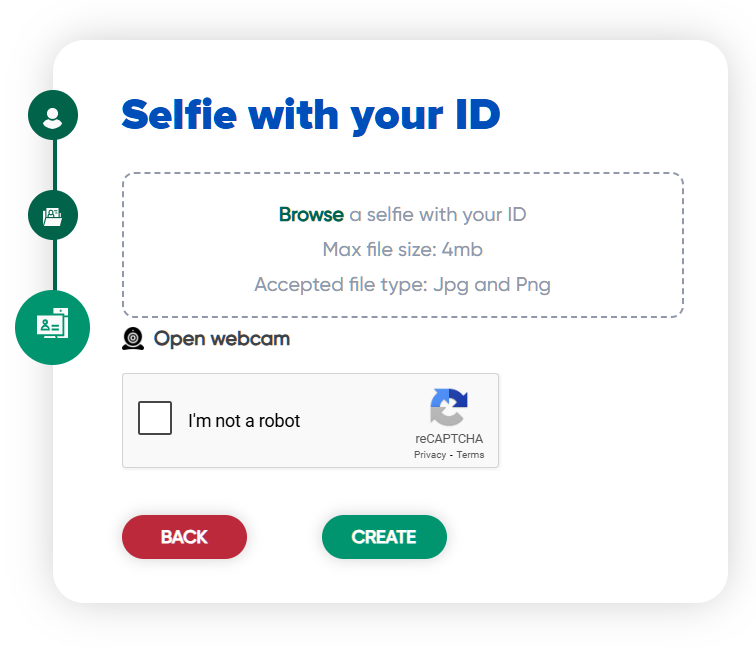

5. Prepare and upload your documents: a photo of your signature over your printed name, two valid government-issued IDs, and a selfie holding your ID.

Click Create to submit your application.

6. Wait for account activation within 1-2 days. Fund your account with at least ₱10,000 and start trading on the web or mobile.

Take note, as of 2025, the minimum initial funding is now ₱10,000. This still makes it relatively accessible, especially if you’re serious about putting skin in the game.

AAA Equities Fees: Lower Cost, More Gains?

AAA Equities fees are at par, if not lower, than other online brokers. Let’s quickly look at the numbers:

| Fee Type | Amount | Example (₱100k gross trade) |

|---|---|---|

| Brokerage Fee | 0.25% or ₱20 minimum | ₱250 |

| VAT on Broker’s Commission | 12% of commission | ₱30 |

| PSE Fee | 0.005% | ₱5 |

| SCCP Fee | 0.01% | ₱10 |

| Sales Tax (when selling only) | 0.6% | ₱600 (not applicable to BUY orders) |

The VAT, PSE, SCCP, and sales tax are unavoidable across all brokers. It’s standardized by the government. But the lower base commission helps you save, lalo na sa maliliit na trades.

For example, kung nag-invest ka ng ₱5,000 in stocks, paying ₱20 versus ₱50 in fees already saves you around ₱30. Hindi siya malaki at first glance, pero when you do monthly investments (say, ₱5K every month), those savings add up over time.

And if you’re practicing cost averaging (regularly buying stocks over time regardless of price), lower fees mean more of your money goes into investments, not overhead.

Conditional Orders and Cutting Losses on AAA Equities

One underrated but super helpful feature of AAA Equities is their support for conditional orders, something not all local brokers offer in a beginner-friendly way. If you’re new to stock investing, this might sound technical, but don’t worry, let’s break it down simply.

Conditional orders allow you to automate your buy or sell actions based on a specific price point. For example, imagine you bought a stock at ₱10. You can set a conditional sell order so that if it drops to ₱9 (a 10% drop), it will automatically sell, helping you cut your losses and protect your capital. This is what investors call a cut-loss strategy.

Why This Matters for Filipino Investors

Let’s be real, most of us can’t monitor the stock market 24/7. Maybe you’re busy with work, school, or running a small business. Having this feature means you won’t need to panic-check your phone every time the market moves.

Instead of emotionally reacting (e.g., “Hala, bumagsak yung stock! Ibenta ko na ba?!”), your cut-loss threshold is pre-set, so your decision is consistent and logical. It’s one of the most important risk management tools in investing, and AAA Equities gives you access to it even as a beginner.

You can also use it the other way around. You can set a conditional buy if a certain stock drops to a price that you think is a bargain. Let’s say ACEN is trading at ₱3.0, but you only want to buy it at ₱2.8 — just set the condition, and the system will do it for you.

How to Use Conditional Orders on AAA Equities

If you want to automate your trades using conditional orders, like selling when a stock drops to your cut-loss level, here’s how to do it using their platform. See the video and step-by-step procedures below:

1. Go to Trade on the left sidebar.

2. Choose whether you want to Buy or Sell.

3. Input the stock symbol.

4. Go to the Conditional tab and fill out the following fields.

| Field | What to Input |

|---|---|

| Condition Type | Select Last Price — this means the condition is based on the most recent trading price. |

| Condition | Choose whether you want to trigger the order when the price is Greater Than, Less Than, or Equal To your target price. |

| Price | Input your trigger price — the price at which the condition will activate. |

| Condition Expiry Date | Select the date until when this condition should remain valid. After this, the condition expires automatically. |

5. After setting the condition, go to the General tab to configure the actual order to be placed:

| Field | What to Input |

|---|---|

| Order Type | Choose Limit (this lets you control the price you’re willing to buy/sell at). |

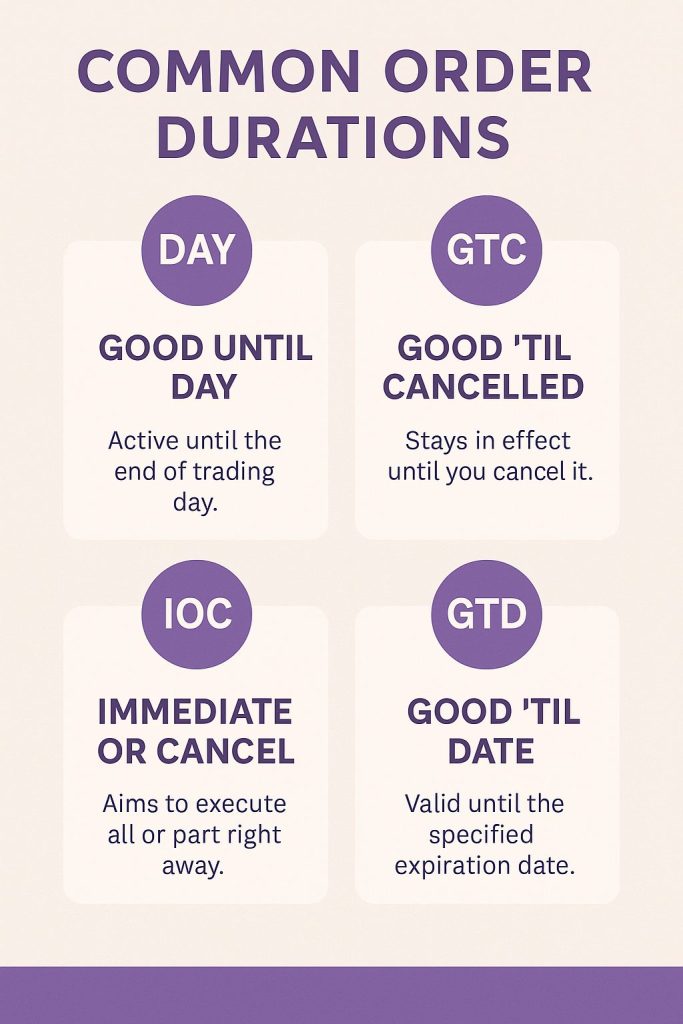

| Good Till | Choose DAY, GTC, IOC, or GTD depending on how long you want the order to stay active after the condition is triggered. |

| Quantity | Enter how many shares you want to buy or sell. |

| Price | Re-enter the trigger price (or your preferred execution price if different). This is the price your order will execute at once the condition is met. |

6. Click Buy and Confirm. You can now wait until the system executes your order once the set condition is met.

It’s like having a personal assistant watching the market for you, and acting based on your plan, not your emotions.

Platform: User Experience on Web and Mobile

AAA’s platform is available on both web browsers (accessible on desktop/laptop) and mobile app (available on Android and iOS).

Compared to COL Financial and other brokers, many users say AAA’s UI feels more modern. The dashboard is clean, responsive, and designed with real traders in mind, including customizable watchlists, order books, and account summaries that are easier to understand.

So if user experience matters to you (and it should!), you might find AAA’s system easier to navigate than older platforms.

Pros and Cons (Updated for 2025)

Like any stockbroker, AAA Equities isn’t perfect, but it’s one of the strongest options for Filipinos who want practical tools, fair pricing, and a clean, tech-forward experience. Before you open an account, it’s worth considering both the advantages and potential limitations, especially if you’re comparing it to other local platforms like COL Financial or BDO Securities.

Here’s a closer look at the updated pros and cons of AAA Equities in 2025:

Pros

- Has both web and mobile trading platforms

- Supports conditional orders (automated cut-loss and buy triggers)

- User interface is modern and intuitive

- Minimum trading fees (₱20 or 0.25%)

Cons

- Requires a ₱10,000 initial deposit

- Not yet as popular as COL or BDO

- Customer service can be slow to respond during peak times

- Only offers Philippine stocks

AAA Equities vs Other Online Brokers (2025 Comparison)

Here’s a side-by-side look at AAA Equities versus four of the most commonly used trading platforms in the Philippines: COL Financial, BDO Securities, First Metro Sec, and BPI Trade.

| Broker | Min Deposit | Fees | Mobile App | Conditional Orders | User Interface | Strength |

|---|---|---|---|---|---|---|

| AAA Equities | ₱10,000 | 0.25% | Yes | Yes | ⭐ Advanced | Risk management tools (cut-loss automation) |

| COL Financial | ₱1,000 (Starter)₱25,000 (Plus) | 0.25% | Yes | No | Basic | In-depth research and educational tools |

| BDO Securities | ₱0–₱50,000 (depends on promo) | 0.25% | Yes | No | Decent | Seamless for existing BDO banking clients |

| First Metro Sec | ₱1,000 (for Metrobank clients) | 0.25% | Yes | Yes | ⭐ Advanced | Comprehensive tools with advanced features |

| BPI Trade | ₱500 | 0.25% | Yes | No | Decent | Easy funding for BPI users |

If you’re focused on automating your strategy (e.g., cut-loss levels), AAA Equities is your best bet. But if you want research-heavy tools, COL Financial still leads. For bank-integrated platforms, BDO and BPI are worth considering, though interface-wise, they may feel a bit behind.

Directory

AAA Equities Office Address: Ayala Tower One and Exchange, Unit 1511, Ayala Avenue cor. Paseo de Roxas, Makati City

AAA Equities Email Address: support@aaa-equities.com.ph

AAA Equities Contact Number: (02) 8403 2927

AAA Equities Office Hours: Mon-Fri 9 AM – 5:30 PM

Final Thoughts: Should You Open an AAA Equities Account in 2025?

If you’re serious about investing in Philippine stocks this 2025, AAA Equities gives you one of the most practical, tech-forward experiences available. It’s great for both beginners and intermediate investors who want a balance of control, automation, and affordability.

From its mobile app to its conditional orders, to the modern trading interface, it delivers a full-featured experience that many other brokers still lack, without charging you extra for it.

So kung ready ka nang mag-invest (and stay in control of your risks), AAA Equities is definitely worth opening an account with.

Explore other brokers: