Sickness and injuries are unpredictable and often come when we least expect them. The good thing is that if you are an active SSS member, you can claim your SSS Sickness Benefit, which aims to lift some of the burden off your shoulders.

Not being able to work is a big deal for most people. Losing days of income while the expenses and bills continue to pile can take a toll on anyone, especially if you are already sick. This guide will walk you through the process of claiming SSS Sickness Benefit for your hospitalization and cash allowance so you can recover with peace of mind.

What is the SSS Sickness Benefit?

This benefit provides a cash allowance to members who are unable to go to work due to illness or injury.

For example, a member was diagnosed with dengue and was hospitalized for 5 days. During that period, the worker was unable to report to work due to her condition and subsequent hospitalization. To make up for the lost income, she can apply for the SSS Sickness Benefit.

Who Can Apply For The SSS Sickness Benefit?

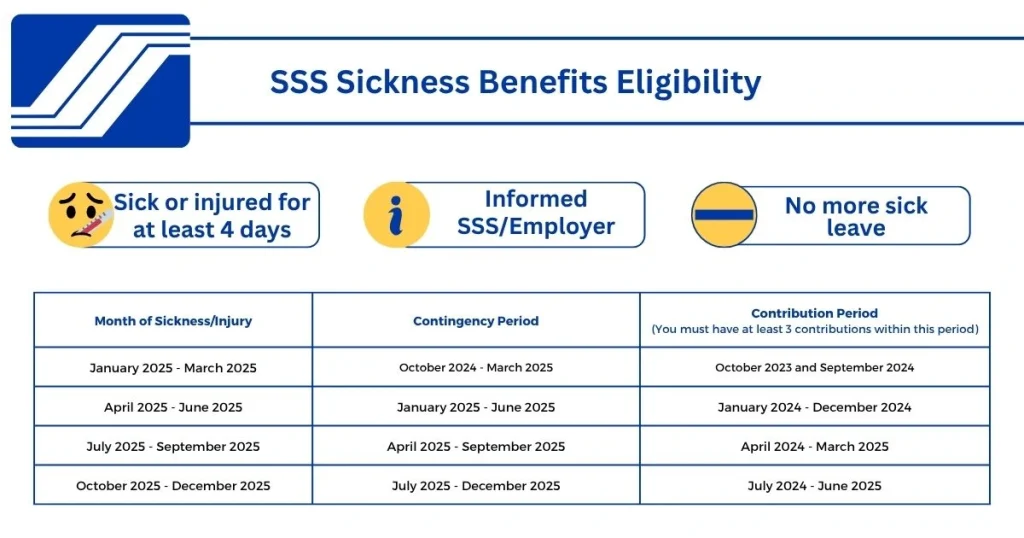

Aside from being sick or injured, the SSS member must also meet the following conditions to be eligible:

- Employed Members

- Unable to work and was confined either at a hospital or at home for at least 4 days

- Has at least 3 monthly contributions within the contribution period (see table above).

- Has informed the employer of the sickness or injury

- Has used up all paid sick leave for the year

- Self-Employed/OFWs/Voluntary Members

- Unable to work and was confined either at a hospital or at home for at least 4 days

- Has at least 3 monthly contributions within the contribution period (see table above).

- Has informed SSS of the sickness or injury

SSS Sickness Benefit

Now that you’ve verified your eligibility, you may be wondering how much cash allowance you are entitled to.

Follow these steps to manually compute your sickness benefit:

- Determine your six highest contributions from the eligible contribution period (see here).

For example, if you were hospitalized in May 2025, get your six highest payments between January 2024 to December 2024. - In the SSS Contribution Table, locate the equivalent Monthly Salary Credit (MSC) for each contribution. Note that the MSC is capped at ₱20000.

For example, if you are employed, a ₱2805 contribution converts to ₱18500 MSC. - Add up the six MSC values and divide by 180 days to get your Average Daily Salary Credit (ADSC).

- Multiply your ADSC by 90%. The resulting value is your Daily Sickness Allowance.

- Finally, multiply your Daily Sickness Allowance by the number of days you were confined at home or at the hospital due to sickness. See the example below.

If manual calculation feels too much, you can use our SSS Sickness Benefit calculator below. Simply choose your membership category, input your six highest contributions, add how many days you were confined, then calculate. Just make sure all the values are accurate so you won’t get an error.

SSS Sickness Benefit Calculator

Enter your six highest monthly contributions:

Note: Minimum of 4 days confinement is required to qualify for sickness benefit.

Benefit reminders

Note that you can only claim up to 120 days of sickness each calendar year. Any excess for the current year will be added to the following year.

Additionally, you can only claim a total of 240 days for one illness. If your need exceeds that, the condition will be considered a disability, which will make you eligible for Disability Benefit instead.

How To Apply For SSS Sickness Benefit

The requirements for the application vary depending on your membership category.

Documentary Requirements

To avail of the SSS Sickness Benefit, the member must secure the following documents:

- Medical Certificate (Med 01688) indicating the following:

- Complete diagnosis

- Recommended number of days of sick leave, including recuperation

- Clinic Address

- Contact Number

- License number written legibly

- Certified true copy of supporting medical documents

If the medical certificate is issued abroad, make sure it has an English translation and is duly authenticated by the Philippine Embassy.

Employed

If you are employed, you don’t need to apply for your sickness benefit by yourself. Instead, you have to promptly notify your employer of your condition and submit the requirements listed above.

- Home Confinement

If you underwent home confinement, you must notify your employer within 5 days of the start of confinement. Your employer is also given 5 calendar days to submit your claim to SSS. So if you have contact with your HR or employer, it’s best to remind them. - Hospital Confinement

If you were hospitalized, your employer can file for the benefit within one year of your date of discharge.

Self-Employed / Voluntary / OFW

If you fall under these categories, you have more flexibility because you are filing for your claim. You don’t have an employer to notify, and you can monitor the progress yourself.

- Home Confinement

If you underwent home confinement, you must submit your sickness benefit application within 5 calendar days from the start of confinement. - Hospital Confinement

If you were hospitalized, you can file for the benefit within one year from your date of discharge.

Self-employed and voluntary members who were previously employed must also submit a Certificate of Separation from Employment with the effective date. This certificate must also show that no advance payment was granted if the confinement occurred before the date of separation.

The Certificate of Separation from Employment is not required if the separation is due to any of the following cases. Instead, these documents must be submitted:

- Company is on strike

- Notice of strike duly acknowledged by the Department of Labor and Employment (DOLE); and

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted

- Company is dissolved

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

- Company has ceased operation

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

- There is a case pending before a court regarding separation of member

- Certification from DOLE; and

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

- AWOL or strained relation with the employer

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

Business Employers

If you are a business owner registered as an employer, SSS grants you more time to process your application.

- Home Confinement

If you underwent home confinement, you can submit your sickness benefit application within 1 year from the start of confinement. - Hospital Confinement

If you were hospitalized, you can file for the benefit within one year of your date of discharge.

Members should ensure the timely submission of their sickness benefit application to avoid denial or reduction of benefit. If the claim was submitted beyond the prescribed 5 calendar days, the start date will be moved to a later date, which will result in lower compensation.

Application Process

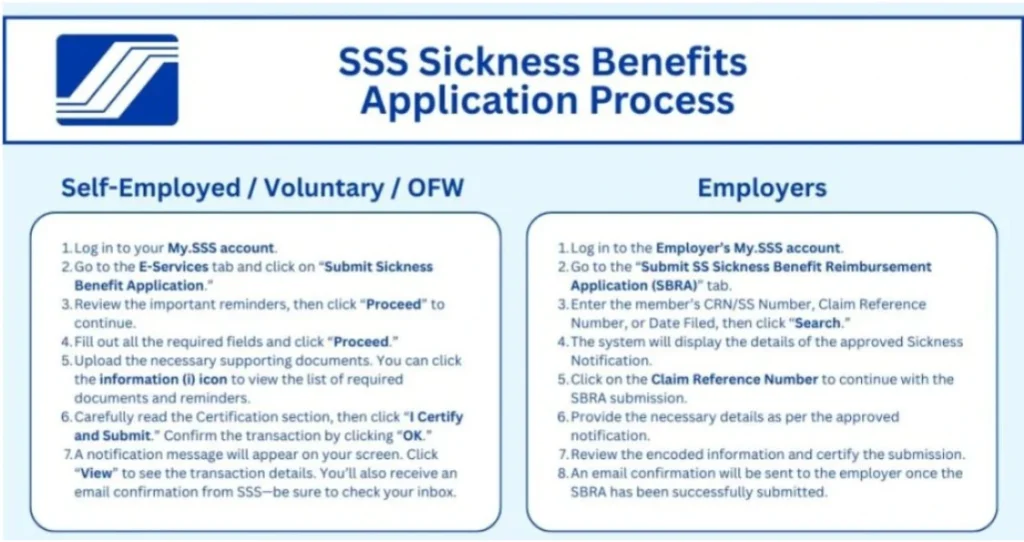

The good news is that applications can be done entirely online. If you are a self-employed, voluntary, or OFW member, you can apply for your SSS Sickness Benefit straight from your My.SSS account.

The same goes for employers. You can process the Sickness Benefit Reimbursement Application (SBRA) for you and your employees by accessing the employer’s My.SSS account.

Here are the step-by-step application processes:

While most applications can be done online, there are a few exemptions because they are a bit more complicated. Denied claims that are reconsidered for payment, unclaimed benefits of deceased members, and unclaimed reimbursement of inactive, closed, terminated, or retired employer needs to be processed over the counter at any SSS branch.

SSS Sickness Benefit Disbursement

Getting sick is already tough; you wouldn’t want to worry about how you’ll receive your benefits when you’re already recovering, right? Thankfully, SSS has made the disbursement process easier and more convenient through electronic channels.

The first option for disbursement is through the qualified payee’s ATM-activated UMID card. If you have the latest UMID card, which works on the ATM, you can expect to receive your benefit on it.

However, some Filipinos still have the old SSS card or may not have availed of any SSS or UMID cards yet. In cases like this, you are required to file a disbursement account. This could be in the form of:

- PESONet participating banks (almost every PH bank qualifies for this)

- E-wallets such as Coins.ph, GCash ,and PayMaya

- Accredited remittance transfer companies (RTCs) and cash payout outlets (CPOs) such as M Lhuillier and TayoCash, Inc.

Depending on your disbursement option, prepare the following details:

| Disbursement Method | Required Info | Monthly Limit |

| PESONet Bank | Bank name + account number | ₱200,000 |

| E-Wallet | Mobile number linked to the e-wallet | ₱100,000 |

| RTC/CPO | Mobile number only | ₱100,000 |

You will also be asked to submit proof of identity and account:

- A clear photo or scan of your government-issued ID

- A proof of account (like a bank statement, screenshot of your e-wallet account, etc.)

- A selfie holding both the ID and the proof of account

Make sure your uploads are either JPEG or PDF format for smooth processing.

For bank accounts, the cardholder must have the same name as the registered SSS member.

For e-wallets, make sure that the expected benefit does not exceed your account limits. You may want to undergo e-wallet account verification to increase your limits.

For RTO and CPO disbursements, make sure you the submitted mobile number is active because SSS will send the disbursement details once available.

For additional inquiries or concerns, you may contact SSS through SSS Hotline (1455) and email at usssaptayo@sss.gov.ph