Pregnancy is a blessing, but we can’t deny that it is also financially draining. Thankfully, when it’s time to bring your baby out into the world, the SSS Maternity Benefit is there to help you with the expenses. Be it for childbirth or unfortunate situations like miscarriage and emergency termination of pregnancy (ETP), SSS is there to help.

What is the SSS Maternity Benefit?

This benefit provides a daily cash allowance to members who are unable to work due to childbirth, miscarriage, or ETP.

This benefit is available to all individuals, regardless of age, marital status, employment status, the legitimacy of the child, or the frequency of pregnancy. Solo parents are also given an additional 15 days of allowance to make up for their situation.

Who Can Apply For SSS Maternity Benefits?

Needless to say, one has to be pregnant to avail of the SSS Maternity Benefit. Aside from that, the member must have paid at least 3 contributions within 12 months before the contingency period.

Employed

If you are currently employed, you must have notified your employer about the pregnancy and the expected date of childbirth. You must submit the Maternity Notification Form along with any of the following proof of pregnancy:

- Result of pregnancy test duly signed by the physician/municipal health officer

- Results of other diagnostic tests (ultrasound and blood pregnancy tests)

Once received, your employer is then required to transmit that information to SSS.

Previously Employed / SE / VM / OFW

For previously employed, self-employed, a voluntary, non-working spouse, or an OFW member, you are required to notify SSS yourself. Prepare the information and documents above to avoid delays in the processing.

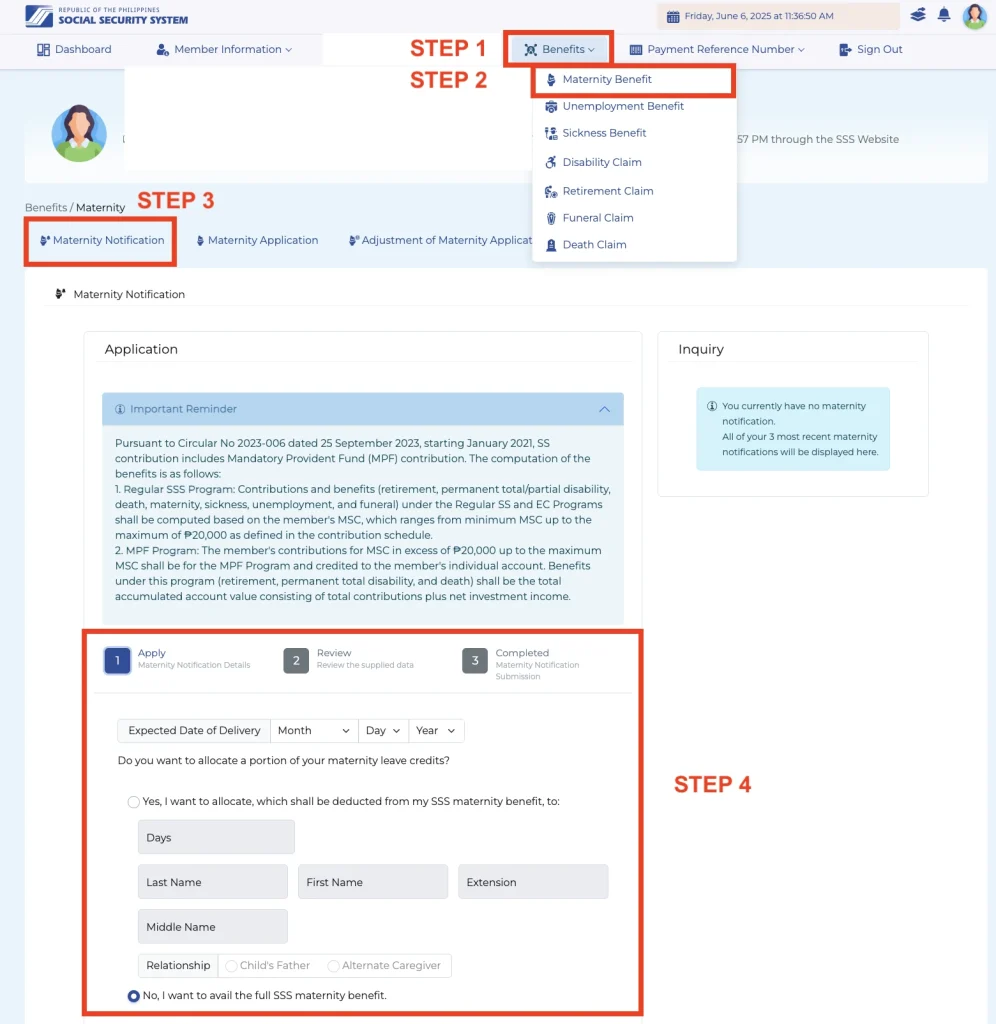

- Log in to your My.SSS account.

- Click Benefits. In the dropdown, choose Maternity Benefit.

- Go to the Maternity Notification tab.

- Fill in the required information, such as the expected date of delivery, and if you intend to share your maternity leave credits with the child’s father or an alternate carer.

- Review and submit once the details are finalized.

How to Compute Your SSS Maternity Benefit?

Now that you’ve verified your eligibility and have duly notified your employer or SSS, your next question would be, how much cash allowance are you entitled to?

For each day of qualified maternity leave, the mother is entitled to 100% of her Average Daily Salary Credit (ADSC) multiplied by the compensable period:

ADSC x compensable period = SSS Maternity Cash Allowance

The compensable periods are as follows:

- Normal and caesarean section: 105 days

- Solo parent: 120 days

- Miscarriage, ETP, or stillbirth: 60 days

For employed members, their employers are also mandated to pay for the difference between their regular daily wage and ADSC unless the business falls into any of the following exemptions:

- Distressed establishments

- Retail/service establishments with no more than 10 workers

- Micro-business enterprises with total assets of not more than P3M

- Those with similar or more than the proposed benefits

Manual Benefit Computation

Follow these steps to manually compute your benefits:

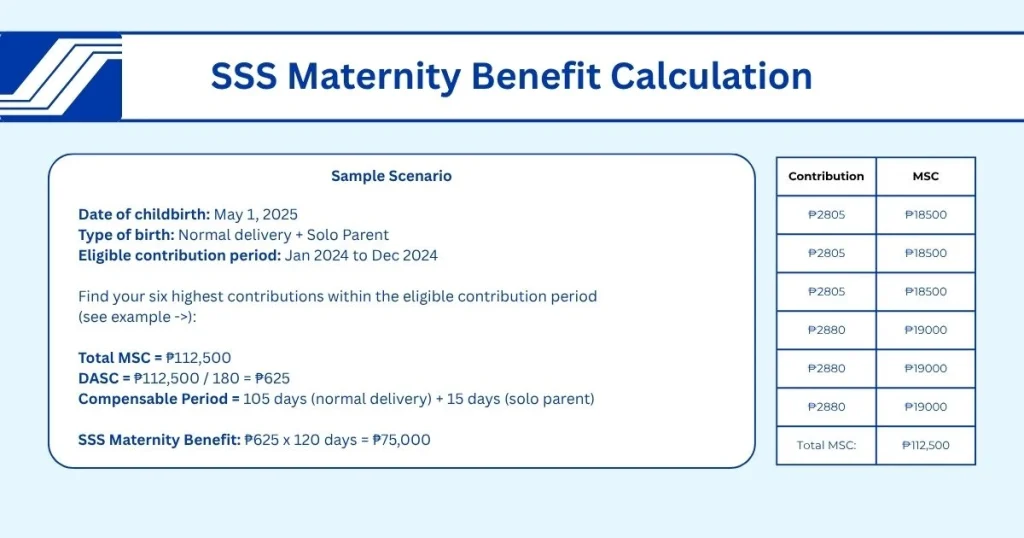

Step 1

Determine your six highest contributions from the eligible contribution period. For example, if you gave birth in May 2025, get your six highest payments between January 2024 and December 2024.

Step 2

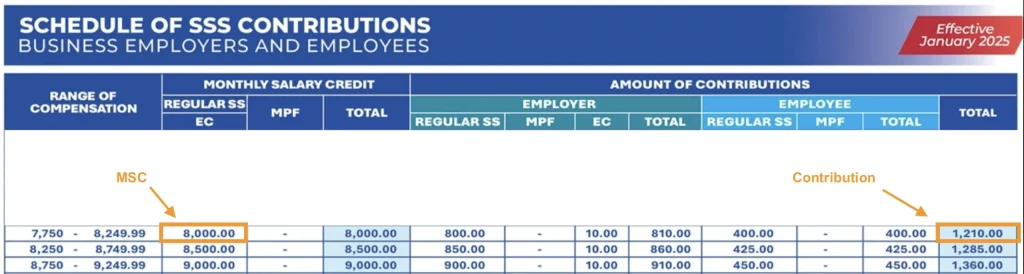

In the SSS Contribution Table, locate the equivalent Monthly Salary Credit (MSC) for each of the six contributions. For example, if you are employed, a ₱1,210 contribution converts to ₱8,000 MSC.

Step 3

Add up the six MSC values and divide by 180 days to get your Average Daily Salary Credit (ADSC). Finally, multiply your ADSC by the applicable compensable period.

If manual calculation feels like too much, you can use our SSS Maternity Benefit calculator below. Choose your delivery type and input your six highest contributions, then calculate.

Just ensure that all the values are accurate to avoid errors.

SSS Maternity Benefit Calculator

Enter your six highest monthly contributions:

Benefit Reminders

Note that you cannot receive SSS sickness benefits during the same period you’re getting maternity benefits. Only one benefit is allowed at that time.

If two maternity claims overlap, both can be granted but will be paid one after the other. Any overlapping days will be deducted from the second claim.

Lastly, regardless of the number of babies delivered (e.g., twins, triplets), only one maternity benefit will be given per childbirth.

How To Apply For the SSS Maternity Benefit

The requirements for the application vary depending on several factors, including membership type, delivery type, and the date of childbirth, miscarriage, or ETP.

There are also differences in the documentary requirements for members who gave birth before or after March 11, 2019, when R.A. 11210, or the Expanded Maternity Leave Law (EMLL), took effect.

Here are the documentary requirements for the SSS Maternity Benefit Application (MBA):

MBA Requirements for Individual Members

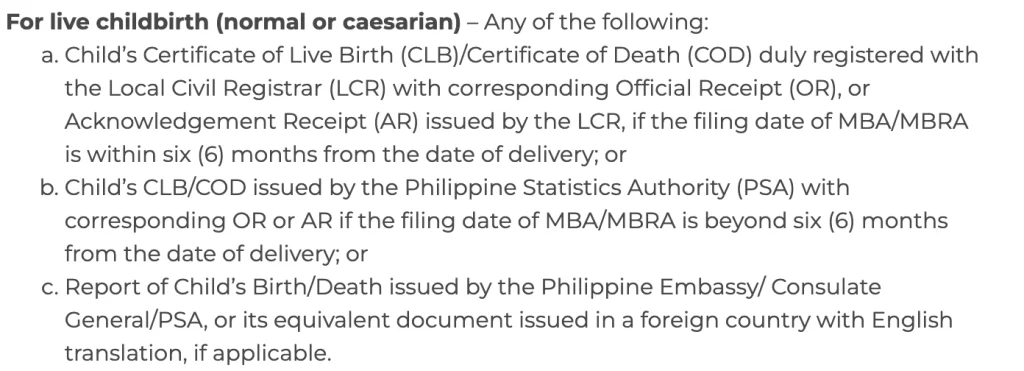

For live childbirth

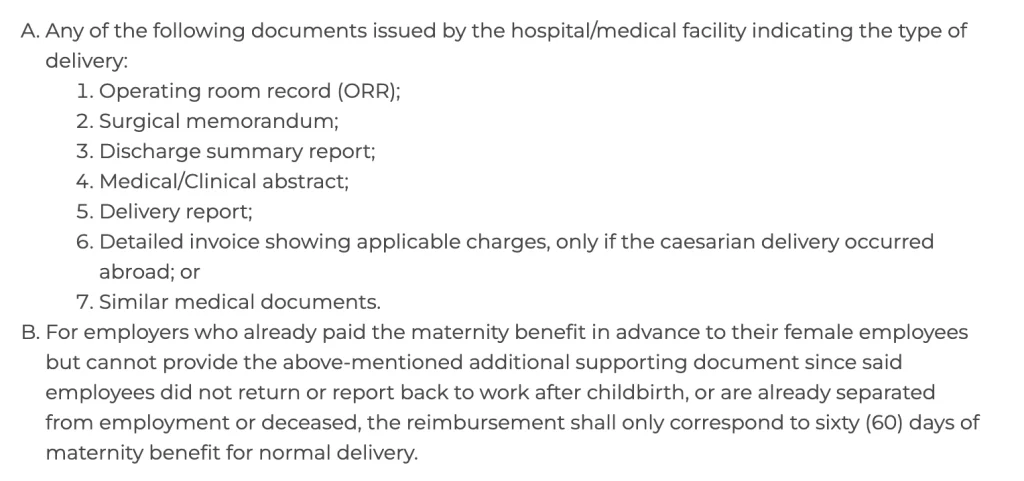

If the childbirth occurred before March 11, 2019, members who underwent a caesarian section must also submit the following:

Additional requirements if you fall under these special circumstances:

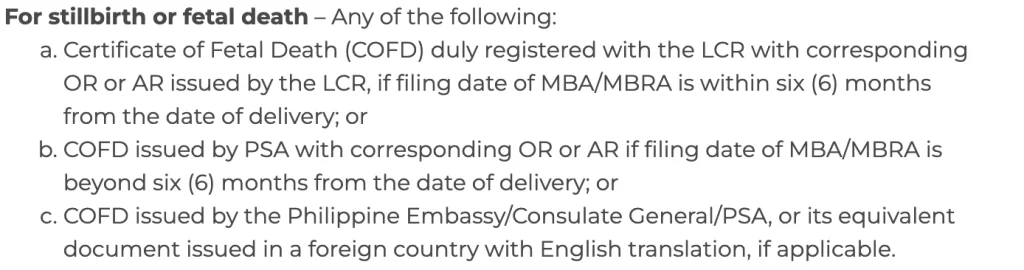

For stillbirth or fetal death

Additional requirements if you fall under these special circumstances:

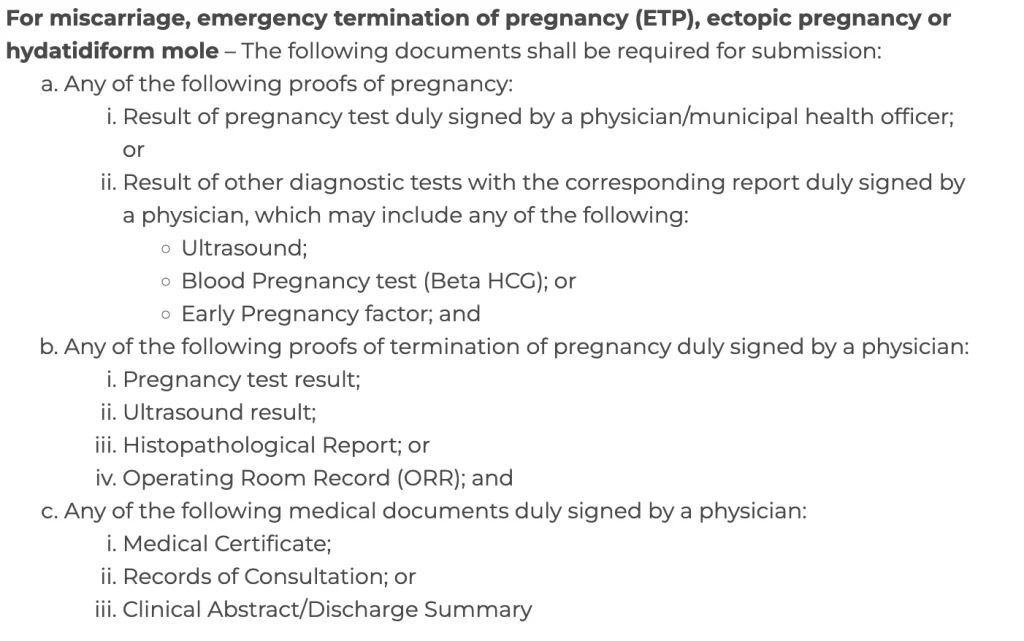

For miscarriage, ETP, etc.

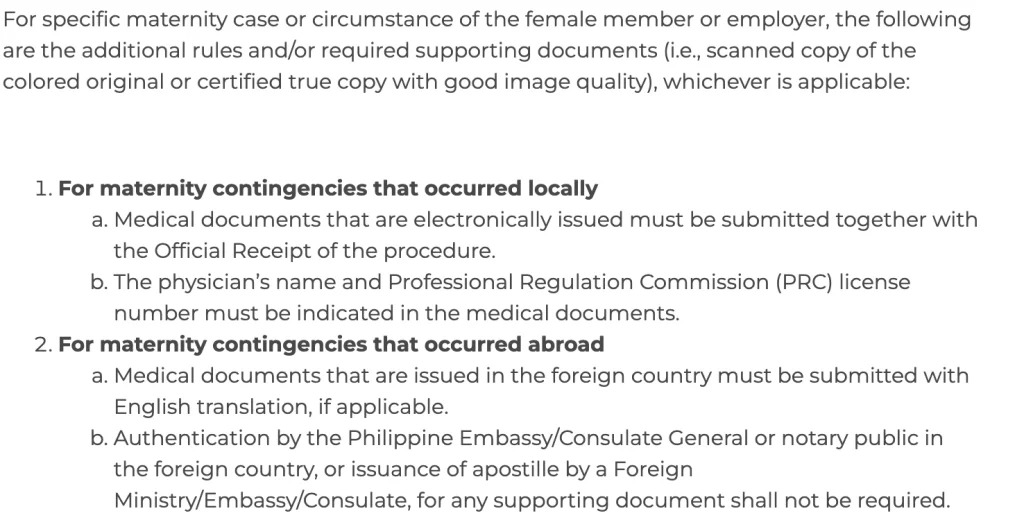

Additional requirements if you fall under these special circumstances:

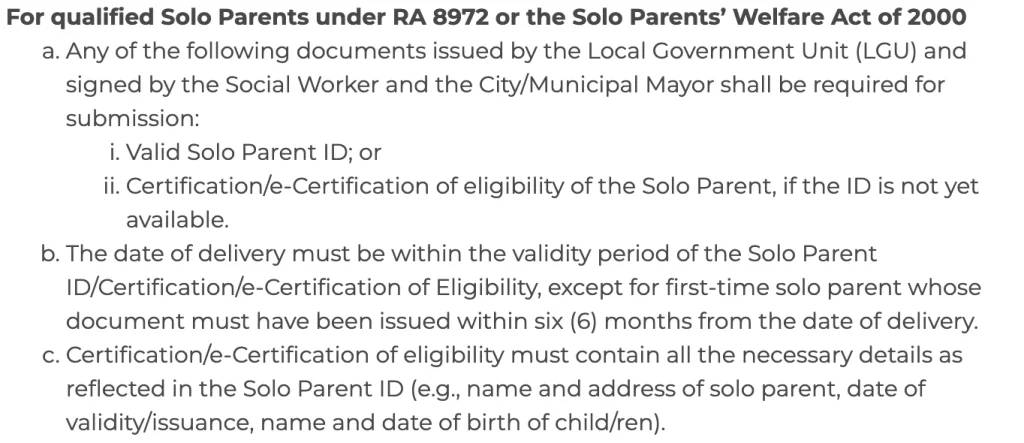

Solo parent

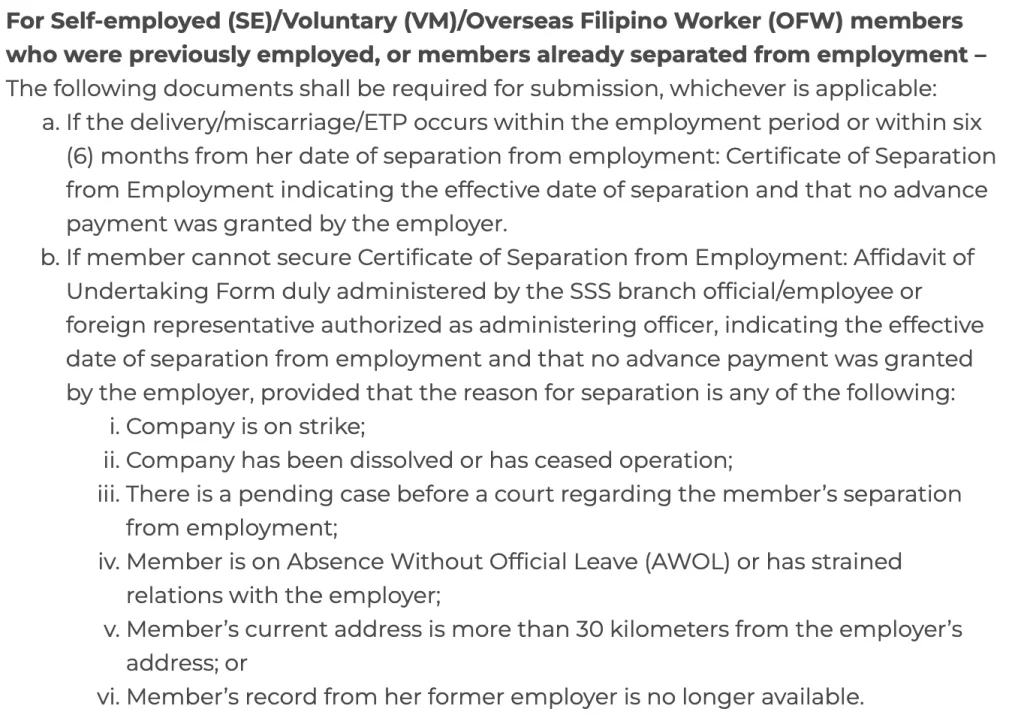

Previously employed

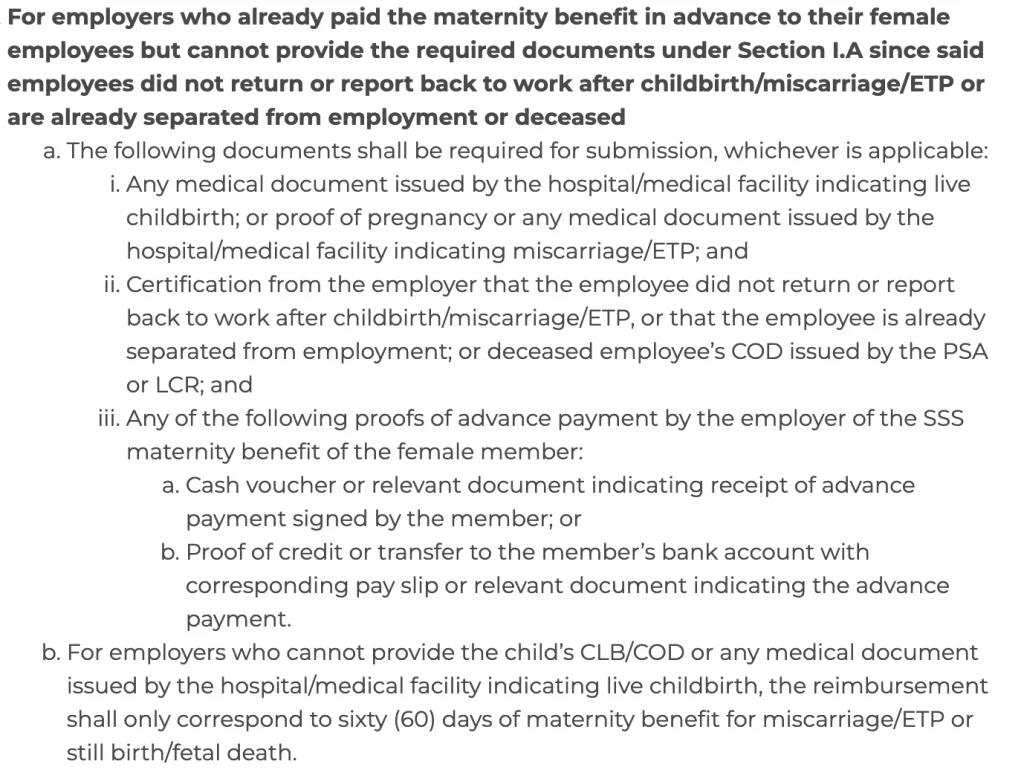

Employer reimbursement

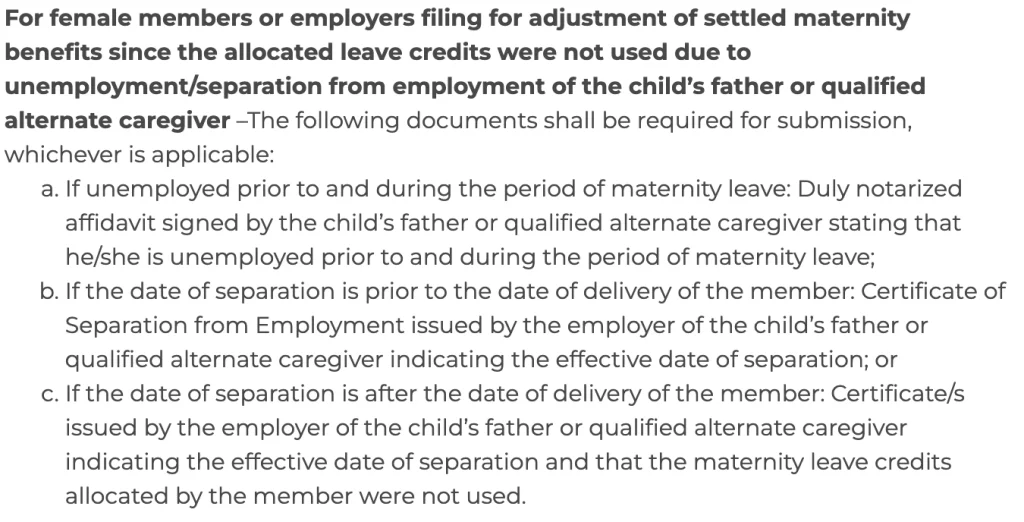

Benefit adjustments

Maternity Benefit Application Process

Submitting your Maternity Benefit Application is easy and can be done entirely online. Here’s an overview of how to do it.

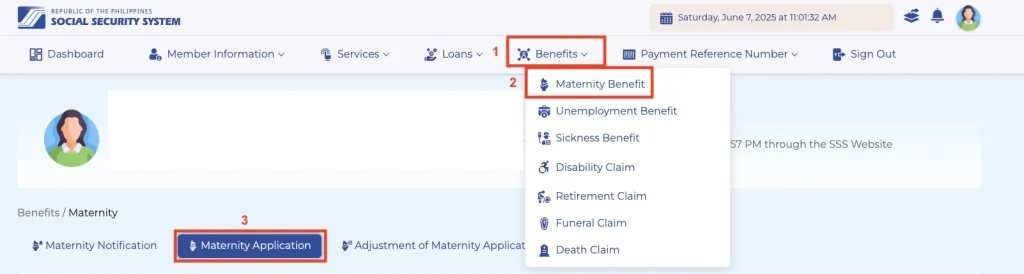

- Log in to your My.SSS account.

- Go to Benefits > Maternity Benefits > Maternity Application.

- Fill in the required Maternity Application Details.

- Submit the required documents.

- Review the information you provided. Once satisfied, you can proceed and submit your application.

Note that employers process your application if you are employed. This process only applies to previously employed, self-employed, voluntary, and OFW members.

SSS will review your application. If approved, the compensation will be deposited into your registered disbursement account. You will also receive a notification after crediting. To avoid delays, make sure you have updated contact info and a working disbursement account.

If SSS rejects your application due to incomplete information or documents, you can file a new application once you’ve compiled all the requirements.

SSS Maternity Benefit Disbursement

Maternity benefits are credited directly to the enrolled disbursement account in the Disbursement Account Enrollment Module (DAEM) via the member’s or employer’s My.SSS account.

Individual members can enroll up to three (3) disbursement accounts, while employers may register one (1) disbursement account, which may be used across all branches or subsidiaries.

Once the benefit is successfully credited to the enrolled bank, e-wallet, or made available through a remittance center, an electronic notification will be sent. The disbursement status can also be checked through the Inquiry Module in My.SSS.

If the crediting fails, the member/employer must update or enroll a new disbursement account in the DAEM. Then, request re-disbursement via the Benefit Re-disbursement Module in My.SSS.

Adding/Updating a Disbursement Account

If you don’t have or have an outdated disbursement account, you can update the details through your My.SSS account. Go to Services, then Disbursement Account.

Disbursement accounts could be:

- PESONet participating banks (almost every PH bank qualifies for this)

- E-wallets such as Coins.ph , GCash and PayMaya

- Accredited remittance transfer companies (RTCs) and cash payout outlets (CPOs) such as M Lhuillier and TayoCash, Inc.

Depending on your disbursement option, prepare the following details:

| Disbursement Method | Required Info | Monthly Limit |

| PESONet Bank | Bank name + account number | ₱200,000 |

| E-Wallet | Mobile number linked to the e-wallet | ₱100,000 |

| RTC/CPO | Mobile number only | ₱100,000 |

You will also be asked to submit proof of identity and account:

- A clear photo or scan of your government-issued ID

- A proof of account (like a bank statement, screenshot of your e-wallet account, etc.)

- A selfie holding both the ID and the proof of account

Make sure your uploads are either JPEG or PDF format for smooth processing.

For bank accounts, the cardholder must have the same name as the registered SSS member.

For e-wallets, make sure that the expected benefit does not exceed your account limits. You may want to undergo e-wallet account verification to increase your limits.

For RTO and CPO disbursements, make sure you the submitted mobile number is active because SSS will send the disbursement details once available.