If you’re looking for a safe, government-backed investment that offers higher earnings than most bank products, the Pag-IBIG MP2 Savings Program is probably one of the best options today. With its high dividend rates, low minimum savings requirement, and 5-year maturity, it’s become a favorite among Filipino savers, OFWs, employees, and retirees.

This complete, updated guide will walk you through everything you need to know—from how MP2 works to how much you can earn, how to apply, where to pay, and tips to maximize your returns.

How to Open an MP2 Savings Account?

- Prepare the documentary requirements:

- Pag-IBIG Membership ID (MID) Number. Register here if you don’t have one yet.

- One valid ID

- Selfie photo showing your ID Card

- Proof of income/source of funds

- Philippine Passport for former natural-born Filipino

- Certificate of Reacquisition/Retention of Philippine Citizenship (as applicable)

- Go to the Pag-IBIG MP2 Online Enrollment page. Enter your MID number and fill out your details.

- Select your dividend payout option: annual or compounded.

- Download your MP2 Enrollment Form and submit it along with the other requirements.

- Start saving. Your first deposit marks the start of the 5-year countdown.

What Is Pag-IBIG MP2?

Pag-IBIG MP2 (Modified Pag-IBIG 2) is a voluntary savings program that offers higher dividends than the regular Pag-IBIG mandatory savings (MP1). It’s designed for members who want to grow their money safely while enjoying flexible savings options.

Key features of MP2:

- Government-backed (very low risk)

- 5-year lock-in period

- High dividend rates (historically 6–8%)

- Minimum savings of only ₱500

- ₱10 million cap per account, but you can open multiple accounts

- Option to receive dividends annually or compounded

In simple terms:

MP2 = Safe + high-earning + flexible + short-term savings program

If you want a stable, reliable way to grow your money, MP2 is one of the strongest choices available in the Philippines today.

Who Can Enroll in MP2?

According to the Terms & Conditions, MP2 is voluntary and open to:

1. All active Pag-IBIG I members

No income requirements. Employees, self-employed individuals, OFWs, and voluntary members can join anytime.

If you have an inactive account, you can simply pay one contribution to activate your membership. Make sure to pay at least one contribution a year to keep your account active.

2. Former members with other income

Even if you’re no longer employed, you may still join MP2 as long as you have at least 24 Pag-IBIG contributions. This includes:

- Pensioners

- Retirees

- Voluntary contributors

3. Former natural-born Filipinos who reacquired citizenship (RA 9225)

Dual citizens who reacquired Filipino citizenship can also enroll.

There’s no age limit, as long as you have the required contributions, you’re good to go.

Minimum and Maximum Savings Rules

Minimum savings is ₱500 per deposit. This will be recorded based on the date you paid.

Members report a ₱10 million cap per account, but you are allowed to open more than one account if you wish to exceed the limit.

If you deposit more than ₱100,000 at once, you must submit proof of income or source of funds.

If you deposit more than ₱500,000 in a one-time payment, your payment MUST be made through:

- Manager’s check, or

- Personal check

This is for security, auditing, and proper documentation.

Dividend Rules

MP2 offers flexible (not fixed) dividend rates. Rates are higher than regular MP1 savings. Final rates depend on Pag-IBIG’s annual performance and are approved by the Board of Trustees.

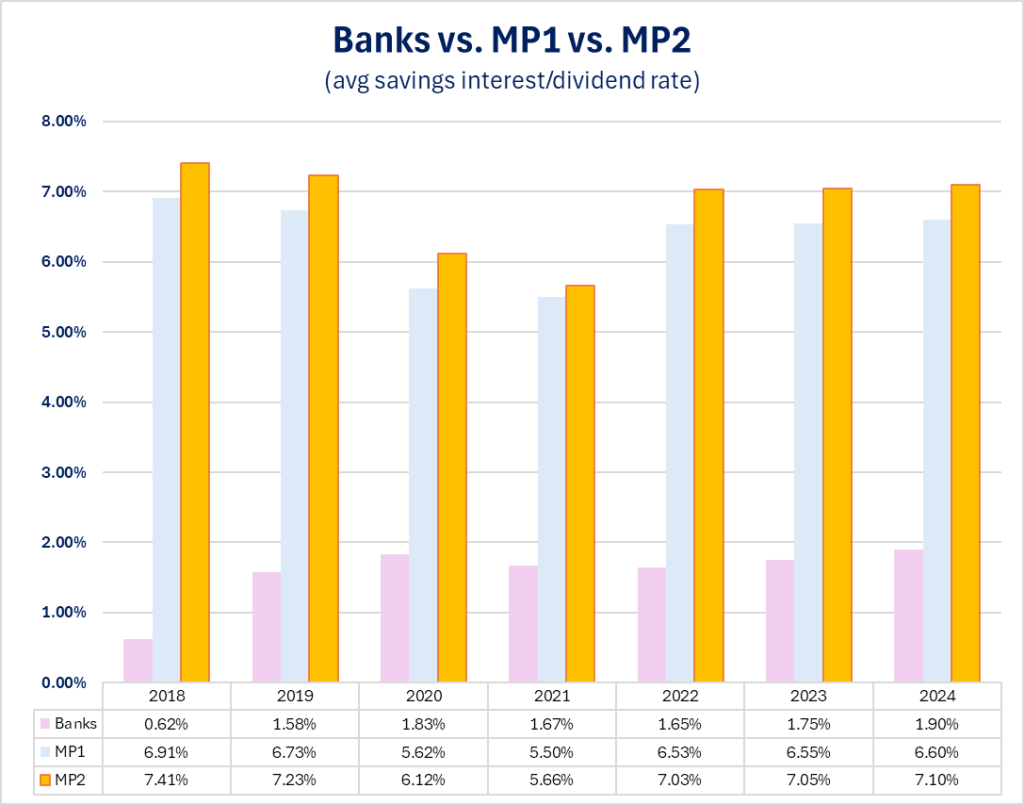

Historical data shows a big gap between bank rates & Pag-IBIG. Bank savings rates have been very low (generally < 2%) throughout these years. Meanwhile, Pag-IBIG MP1 has consistently offered much higher dividend rates (~5.5%–7%) in the same period.

But MP2 delivers even more!

On top of MP1, MP2 has paid even higher, ranging roughly from 6% to ~7.4% from 2018 to 2024.

Because MP2 is relatively low-risk (government-backed) and its returns are far higher than what most banks give for savings, many Filipinos choose to park excess cash there rather than leave it in a regular bank savings account.

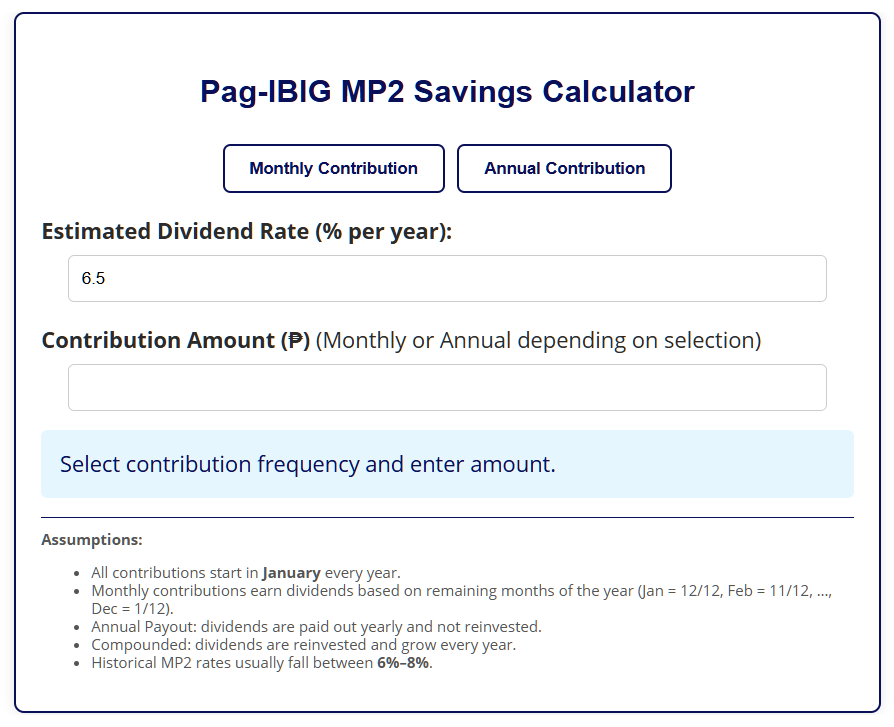

Want to estimate your potential MP2 earnings? Use this MP2 calculator!

Two dividend payout options:

Pag-IBIG MP2 offers two dividend payout options. The first is the Annual Payout, where dividends are released to you every year, which is ideal if you prefer regular cash flow.

The second option is the Compounded or End-of-Term Payout, where your dividends accumulate and are released only after the 5-year maturity. This compounding option typically yields significantly higher earnings because your dividends continue to earn additional dividends over time.

However, if you choose to withdraw your MP2 savings right before the dividend rates for the year are officially declared, Pag-IBIG will apply the latest available dividend rate to your account.

MP2 Term and Maturity

The MP2 membership term lasts five years, starting from the date you make your first deposit, not the date you enrolled. Once your MP2 savings mature, you have two options.

- Option 1: You may withdraw your MP2 savings, allowing you to receive both your principal and your earned dividends.

- Option 2: You may continue saving under the MP2 program, but this requires opening a new MP2 account, since matured accounts can no longer earn MP2 dividend rates.

If you choose not to withdraw your matured MP2 savings, take note that your earnings will change.

For the first two years after maturity, the balance will earn Pag-IBIG Regular Savings rates, which are lower than MP2 dividends.

After those two years, the account will be reclassified as payable, meaning it will no longer earn any dividends. In short, it’s best to withdraw or renew immediately upon maturity so you don’t miss out on higher returns.

MP2 Pre-Termination/Early Withdrawal

You CAN withdraw your MP2 before 5 years without penalty ONLY if you qualify under any of the allowed reasons below:

- Total disability or insanity

- Separation due to health reasons

- Death of the member or an immediate family member

- Retirement

- Permanent departure from the Philippines

- Distressed member (layoff or company closure)

- Critical illness (member or immediate family), including:

- Cancer

- Stroke

- Heart-related illness

- Organ failure

- Neuromuscular-related illness

(Requires certification from a licensed physician and approval from Pag-IBIG DCEO)

- OFW repatriation from host country

- Other meritorious cases subject to Pag-IBIG Board approval

If you withdraw early for reasons NOT included in the allowed list, you will receive only 50% of the total dividends earned. This is the pre-termination penalty.

If you chose annual payout previously, Pag-IBIG will deduct 50% of dividends already released to you, deducted from your principal or final payout.

Dividends for the current year will also be cut by 50%. This will be released separately (second release schedule).

To avoid these penalties, only withdraw early if you truly need to. Otherwise, you lose half of your earnings.

Where to Pay MP2 Savings

- Virtual Pag-IBIG Payment Online: Convenient but comes with a 1.75% fee

- Digital Wallets (GCash, Maya, Vybe, etc.)

- Online Banking

- Over-the-counter (Pag-IBIG branches, SM Business Centers, Bayad Center, Robinsons Business Center)

- Online Payment Channel (Bayad Online)

- Payroll deduction if your employer supports MP2

PRO TIP: Payment via Bayad Online is highly recommended because it accepts credit cards. Pay your MP2 contribution when there are ongoing credit card promos to maximize your benefits.

Finally, is MP2 Safe?

YES! Pag-IBIG MP2 is considered one of the safest high-yield savings programs available. It’s backed by the Philippine government, and the fund invests primarily in low-risk, income-generating assets such as housing loans and government securities.

Pag-IBIG also has a long, reliable track record of delivering positive earnings year after year, even during economic downturns. On top of that, its dividend distributions are fully transparent, audited, and approved by the Board of Trustees, giving savers confidence that their money is well-managed and secure.

Related Posts

Leave a Reply